If you’ve been with me from the previous story on how the commercial invoice (CI) can affect customer satisfaction, then I’ve got a treat for you. Yes, reading about commercial invoices can be a treat – if and when it helps your business to operate better and from that, customers are happy and profits are flowing. That’s a good treat, right!

Last week we were talking about commercial invoices and avoiding border delays. This week we will break it all down for you to ensure you are completely comfortable and confident every time you reach the commercial invoice form.

What is a commercial invoice (CI)?

A commercial invoice is a document used by customs officials to determine:

- The goods being imported are admissible (ie. are you allowed to import all the items in your shipment?); and

- The correct harmonized system (HS) code and rate of duty (ie. how much duty is to be charged on this import?)

When do I need a commercial invoice?

A commercial invoice is required anytime you ship a product outside of the country as long as the shipment contains more than just documents.

How do I properly fill out the commercial invoice?

According to the US Customs and Border Protection (CBP), a commercial invoice should at minimum contain the following information:

- Clear description of each item

- Quantity of each item

- State the value (either price paid, or estimated value based on other considerations.) Give both the value in foreign currency and U.S. dollars

- Country of Origin (where the item was made)

- Where it was purchased

- Name of the business or person selling the merchandise

- Location of the business or person selling the merchandise

- Name and address of business or person buying the merchandise, and if different from the importer

- The address of the person or business the goods are being shipped to

https://www.cbp.gov/sites/default/files/documents/Importing%20into%20the%20U.S.pdf That’s a lot to remember. Is there a simpler way?

I’m glad you asked. There are two ways you can complete the commercial invoice.

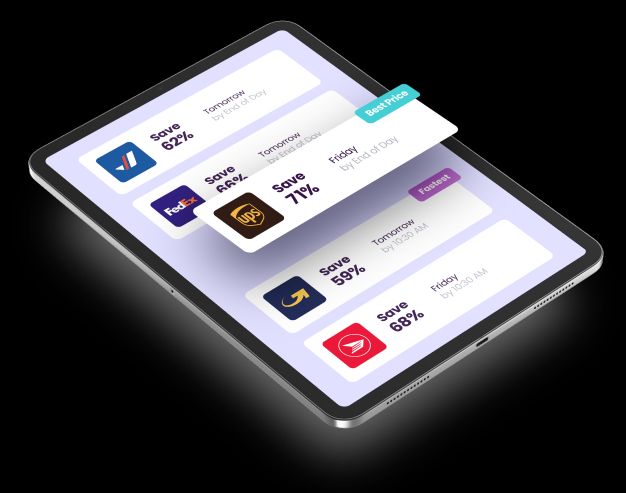

Online shipping tool

The easiest way to create a commercial invoice is to use our online shipping tool. As you create your shipment through our website, our system will automatically determine if a commercial invoice is required and then guide you through it. That means no more forgetting to put Country of Origin or Quantity of items. We’ll even automatically pull the seller’s address, the buyer’s address, and memorize item details so you don’t have to retype them on subsequent orders. Plus we send this information electronically so your shipment has a chance to pre-clear before arriving to the destination country.

Follow a blank template

Another way (but definitely not as good as a shipping tool) is to use this blank fillable commercial invoice

If you’ve made it this far, then you know all the minimum requirements for a commercial invoice – but is that enough? No, it’s most likely not enough! And yes, you should include more than the minimum information!

There are a lot of small details that if missed, could cause your shipment additional delays. Pay close attention to the details, especially if you really need your shipment to get to its destination. It’s always better to be proactive rather than reactive. Over descriptive than under. Here are a few things to look out for:

Tax ID or Social Security Number

For high value shipments, there’s a very good chance that you’ll need to provide the receiver’s business tax ID or social security number. Not sure if you should include it? You can always error on the side of caution and include this information.

Reason for the export

Always provide a reason for export. It can be warranty repair/repair, temporary import, gift, sold, sample of no commercial value.

Note: Some countries require the reason for export (such as ‘GIFT’) to be included with the ‘full description of goods’ as well as the ‘reason for export’. If you forget to do this, you may end up paying more duties.

Country of Origin

This can be a particularly confusing one. It is the country where the item was made – not purchased. We’ve seen a number of packages stopped to confirm where the items were manufactured.

Full Description of Goods

This is probably the most important section of the entire commercial invoice in my opinion and probably the hardest to get right. Always include as much information as possible including the make & model of the product (if it applies).

Not sure if you have all the information you need? Try thinking of it from a customs’ perspective. They’ll want to know

- What the item is?

- What is it made of?

- What is it used for?

- What is it component of? [if applicable]

- What is it composed of? [if applicable]

Unit Value

Undervaluation can cause your shipment to be held and/or re-assessed by customs. Be as accurate as possible here. For samples or articles of no commercial value, you must include a nominal or fair market value for customs. (Make sure you’ve indicated that it is a sample or item of no commercial value under ‘full description of goods’!)

For warranty repairs, you need to include the cost of the repair AND the value of the item. I find it best to put the value of the repair under ‘unit value’ and cost of the item under ‘full description of goods’.

Number of Commercial Invoices

The number of CI’s required varies by country. A standard practice is to include 3 copies of the commercial invoice with your shipment. If you have more than one package with your shipment, include all 3 copies of the CI with package #1. If you have any other export documents (such as B13a, FCC, FDA, CBP3299, TSCA, etc. etc.), always include it with package #1.

If you’re using Secureship to create your shipments, our system will automatically take care of creating the appropriate number of commercial invoices.

One Last Thing

This blog post is our longest yet, but for good reason. Talking commercial invoices isn’t exactly exciting, but what it lacks in entertainment it certainly makes up for in importance. Did you skip any steps to get down here? It’s OK, we’ll forgive you. But in all seriousness, review each point we’ve mentioned before you send out your next shipment. Happy customers = successful business. Now that’s the exciting part.