Not all types of shipments are created equal. Shipping a television will

require different paperwork, duties, and taxes than shipping an accounting

statement, for example.

Here is a list of the most common types of shipments:

You can also skip ahead to the table containing the list of

Commonly Required Documents.

Most documents can be shipped to France duty-free. There are

restrictions on what can be shipped duty-free. If you exceed these

restrictions, then tax and duty becomes payable. Some restrictions are

shown below in the table.

| Document Type | Restriction |

|---|

| Business cards | Up to 15 |

| Greetings cards and invitations | Must be personalised. If blank, an invoice is required. |

| Stationery | Must be personalised |

For more information on restricted documents, click here.

Sources:

https://www.ups.com/ga/CountryRegs?loc=en_US

Sample Commercial Invoice for Documents Only

| Ship To | Invoice |

|---|

Charles de Gaulle

1 Avenue Montaigne

Paris

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Documents Only - Business Cards

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Documents Only : 15 Business Cards

| CA | $10 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Documents Only

Contact Name: James Smith

| Total Invoice Amount: $10

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Gift shipments to France valued at less than €45 (about $67 CDN)

are exempt from duties and taxes, provided the following conditionsare met:

- The words "Gift Shipment" or "Unsolicited Gift" are included on the

commercial invoice (see sample)

- A detailed description of each item is provided

- The value is declared on the commercial invoice

- Shipment is from an individual to individual

NOTE: Shipping a gift to an individual to their work address will cause an issue

- it'll be seen as a commercial shipment and will not be exempt from duties

and taxes.

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

de Gaulle Family in Marseille

Charles de Gaulle

1 Avenue Montaigne

Marseille

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal Shipment / Gift Shipment

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Gift Shipment: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $79.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $79.99

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sending Multiple Gifts to France

You may send multiple gifts in one parcel, BUTthe total value within the parcel must be €45 or less if you

wish to avoid paying duty and taxes. See sample.

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

de Gaulle Family in Nice

Charles de Gaulle

1 Avenue Montaigne

Nice

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Unsolicited Gift: Consolidated Gift Package

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Unsolicited Gift - Roger: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $39.99 |

| 1 Each | Unsolicited Gift - Erica: Handwoven French Canadian Catalogne Blanket

| CA | $49.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $89.98

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sources:

https://www.ups.com/ga/CountryRegs?loc=en_US

http://www.douane.gouv.fr/articles/a14741-les-envois-non-commerciaux-adresses-de-particulier-a-particulier

Customs officials in France are very strict about what are classed as

personal effects and how they are imported.

If your package is checked by officials and it doesn’t meet the

requirements, you could be fined a 20% tax based on the estimated

value of the goods plus the shipping costs.

Moving Temporarily

Students

Personal items that are exempt from customs duties providing you have

owned them for at least 6 months before sending them to France.

Personal items include:

- You have owned or used the items for at least six months before

sending them to France.

- Clothing and accessories, such as shoes and hats

- Educational materials, such as books, paper, computers

- Used household furnishings that a student would typically have

Moving Temporarily (Student) - Personal Effects Checklist

- Clearly indicate "Personal Effects" in the "General Description" or

"Remarks" section on the commercial invoice

- Proof of enrollment

- Two signed and dated copies of a detailed estimated inventory

(packaging list)

- Include 3 copies of the Declaration of Duty Exemption/Entry of Personal Effects (if you wish to import your items duty-free from outside of the EU)

Non-Students

No information is currently available at this time.

Moving permanently

If you are moving to France after being in a non-EU country for more

than a year, you may bring your personal effects into the country tax

and duty-free.

The only condition is that you have used your personal belongings for

at least six months before becoming a resident of France.

NOTE: The exemption does not apply to alcohol, tobacco, and tobacco products.

Moving Permanently - Personal Effects checklist

- 3 copies of the Commercial Invoice

- Each item within the package must be listed on the commercial

invoice

- Give each item a fair market value.

- The items must be at least six months old and can’t look brand

new … otherwise taxes and duties will be payable.

- Copy of valid passport with the photo page

- Copy of Visa, Residence and Work Permit (requirement may vary

according to nationality)

- Complete Formulaire No. 10700: Declaration of Duty Exemption/Entry of Personal Effects

If you need any information on shipping personal effects, you will

need to contact a French Customs Broker. You can find a list here.

Sources:

http://www.douane.gouv.fr/articles/a10793-effets-et-objets-personnels

http://www.douane.gouv.fr/articles/a14707-transferring-your-primary-residence-to-france

Sample Commercial Invoice for Personal Effects

| Ship To | Invoice |

|---|

Lyon Community Centre

Charles de Gaulle

1 Avenue Montaigne

Lyon

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal effects being delivered to my new address.

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 5 Pairs | Personal Effects: 5 pairs of various types of shoes

| IN | $40.00 |

| 1 Each | Personal Effects: Arc'terix Winter Jacket

| CA | $478.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Personal Effects

Contact Name: James Smith

| Total Invoice Amount: $678.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Food and food items like chocolate and candy can be shipped to France

providing they follow the rules and standards established by the

European Union.

What you can send

You can send non-perishable foods providing:

- They were bought in a store

- They have a best-before-date on the label

- The best-before-date is more than 6 months away

- The label lists all the ingredients

Examples of non-perishable foods that can be sent include:

- Canned goods

- Herbs and spices providing they are in sealed containers

- Chocolates and candy

- Jams and other preserves

Do not send

Perishable foods such as:

- Homemade items or food removed from the manufacturer’s

packaging

- Foods with a shelf-life of less than 6 months, for e.g. fresh fruit

and vegetables, meat and fish

- Open packages of food

- Foods without a list of ingredients on the package

Sources:

https://www.laposte.fr/envoyer/envoi-colis-alimentaire

http://www.douane.gouv.fr/articles/a14739-envois-de-marchandises-sanitaires-et-phytosanitaires-et-legislation-alimentaire

http://www.douane.gouv.fr/articles/a10913-restriction-de-circulation-ou-interdiction-de-certaines-marchandises

Sample Commercial Invoice for Food, Chocolate, Candies

| Ship To | Invoice |

|---|

Charles de Gaulle

Charles de Gaulle

1 Avenue Montaigne

Bordeaux

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Food Shipment - Assorted chocolate bars in their original manufacturer's packaging

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Nestle Chocolate Bars in original packaging expiring May 2021 (shelf life of 6 months or longer)

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent / Sold

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Commercial samples are those that can only be used for demonstration

purposes. The aim is to encourage people to place orders of the

samples, not sell them. Samples can be imported into France duty-free

(you may still pay taxes) provided certain conditions are met. French

Customs recommends that you ship samples via an ATA Carnet.

To send samples tax and duty-free to France, the following conditions apply:

- The words "Commercial Sample" are clearly stated on the commercial

invoice (see sample)

- They are imported by a business for the purpose of creating orders;

- The samples are similar to or look like the goods for sale;

- The samples are marked in a way that stops them from being sold. For

example, they may be lacerated, perforated, defaced, or marked with

indelible ink;

- special arrangements must be made with a local broker;

- samples must be re-exported within one year; and

- a deposit will be held by the government as security

NOTE: French Customs will assign a

commercial value for calculating duty and VAT when the package enters

France. This means you may end up paying more or less tax than you

were expecting.

Sources:

https://www.exporthub.com/france/

https://www.legifrance.gouv.fr/affichTexte.do?cidTexte=JORFTEXT000020782407&categorieLien=id

Sample Commercial Invoice for Commercial Sample

| Ship To | Invoice |

|---|

Toulouse Book Store

Charles de Gaulle

1 Avenue Montaigne

Toulouse

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Commercial Sample - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Commercial Sample - Advanced reading copy of Dan Brown's novel.

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Commercial Sample

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Advertising material includes items that are handed out to promote

products or services. Advertising items include:

- Catalogues

- Price lists

- Advertising posters

- Calendars

- Photographs

Advertising material can enter France without incurring duties or

taxes. In order to qualify, the following conditions must be met:

- the words "Promotional Material - Not for Resale" is stated on the

commercial invoice in the general description of goods

- Include the correct Harmonized System (HS) code to avoid paying unnecessary duties and taxes

Sources:

https://www.legifrance.gouv.fr/affichTexte.do?cidTexte=JORFTEXT000020782407&categorieLien=id

Sample Commercial Invoice for Promotional Material

| Ship To | Invoice |

|---|

Strasbourg Tradeshow

Charles de Gaulle

1 Avenue Montaigne

Strasbourg

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Promotional Material - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Promotional Material: Not for Resale. Product pamphlets to hand out at trade show.

| CA | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Promotional Material

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

If you are shipping an item to France to have repair work done, then

the reason for shipping should be clearly noted on the commercial

invoice.

Be sure to include the original Customs documentation with the

shipment.

Customs duties and taxes may be payable on the items when they arrive

in France for repair, as well as on the value of the repair when the

goods arrive back in Canada.

Items Under Warranty

For items that aren’t under warranty or the warranty has

expired, you would have to pay duties and taxes on the repair cost.

Here’s a breakdown of how that works:

- Duty is applied to the total cost of the repair; and

- 20% Goods and Service Tax (VAT) is applied to the total cost of the

repair + shipping cost + Insurance Amount

Sending Product for Repair to France:

If you’re sending your package for repair to France, include the

following information on the parcel:

- The words "REPAIR & RETURN" are stated on the commercial invoice

under General Description or Remarks

- Serial/Product number must be indicated under the Detailed

Description of Goods section on the commercial invoice

- Copy of Repair Contract included with all your export documentation

NOTE: Goods that are no longer under

warranty for repair may require duties and taxes to be paid when the

shipment returns to Canada.

Returning Product After Repairs are Completed:

If your product has been repaired in Canada and is being returned back

to France, ensure to do the following:

- Write "REPAIR & RETURN" on the commercial invoice in the General

Description or Remarks section

- Indicate the value of the product INCLUDING the

Cost of the Repair under the Detailed Description of Goods section

- Include the original shipping documents or tracking number from when

the item was first exported to France

NOTE: If you don’t have the

original tracking information or documentation then the recipient may

be charged duties and taxes on the shipment.

Repair Checklist

- Commercial Invoice must clearly state under the General Description

or Remarks section the following: "REPAIR & RETURN" and include the

estimated time of return

- Include repair contract with shipment

- Serial or product number and the cost of repairs should be indicated

under the Detailed Description of Goods section

Sources:

https://www.expatfocus.com/france/guide/france-vehicle-maintenance-repairs-and-breakdown-recovery

https://www.corintax.com/news/vat-goods-returned-to-france-for-repair-or-processing/

Sample Commercial Invoice for Warranty Repair

| Ship To | Invoice |

|---|

Lille Repair Shop

Charles de Gaulle

1 Avenue Montaigne

Lille

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Repair and Return - Watch being sent for repair

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Fossil Watch being sent for repair - Model E5, serial # 789456FG7E2 - Repair Cost $76.00

| US | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Warranty Repair

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Temporary importation of certain goods into France, without incurring

duties or taxes, is allowed for a period of up to 12 months. Make sure

to clearly indicate the return date on the commercial invoice.

Goods that are often part of a temporary import include:

- Items that will be used or displayed at a fair, exhibition or event

- Scientific and professional equipment

- Commercial samples

- Tools and specialised equipment required for repairing, exploring,

producing or manufacturing

- Materials and goods to be used for entertainment or during a public

exhibition such as a trade show booth

- Equipment required to evaluate and test the operation of other goods

and equipment

Qualifying for Duty & Tax Free Temporary Import

In order to import your goods duty and tax free into France, you can

pick from 1 of the 3 Temporary Import Methods listed below.

Each option has its pros and cons. Regardless, each of the following

methods requires you to complete a Commercial Invoice (CI). More

details below.

| Option # | Temporary Import Method | Risk of paying |

|---|

| 1 | Commercial Invoice Only (no other documentation is provided) | High - if broker cannot clear goods temporarily |

| 2 | Commercial Invoice + Customs Declaration with French customs

done through DELTA, the online service for customs clearance | Very Low |

| 3 | Commercial Invoice + ATA Carnet | Very Low |

| 1. Complete a Commercial invoice only

This is the simplest and quickest option. See example.

NOTE: You should be aware that

shipping using this method doesn’t guarantee that your

items will be imported duty/tax free. Not all brokers will

clear goods as temporary imports (i.e. UPS, Fedex, DHL) nor

is it a guarantee that customs won’t charge any duties

and taxes

2. CI + Online Customs Form In addition to completing a Commercial Invoice (CI) you can

also complete the French Customs form for temporary imports

through the Delta website. FYI - Customs clearance provided by the major carriers such

as FedEx, UPS, DHL, etc. do not offer this service. 3. CI + an ATA Carnet This option is great for items that frequently travel in and

out of the country. It’s also great because once you

have an ATA Carnet, it is accepted by 176 countries

worldwide making the application process a one-time thing. In addition to declaring your commercial invoice as a

temporary import, you can get an ATA Carnet for the items

that are of temporary nature. ATA Carnets are beyond the scope of this article. You can

however, contact your local chamber of commerce and they

will be able to guide you along. You can also find more

information here: http://www.chamber.ca/carnet/ |

In addition to 1 of the 3 items above, the following conditions must also be met in order to qualify for a duty and GST free exemption:

- The goods arrive and leave in the same condition, i.e. they undergo

no repairs nor are they used in manufacturing

- Stay no longer than 12 months in France

NOTE: - If the above conditions are not followed, duties and taxes will be

charged as though the goods have been imported permanently.

- Your Customs broker can clear goods of a temporary nature (FedEx,

UPS, DHL, etc. typically cannot clear goods of temporary nature)

Temporary Imports Checklist

- Commercial Invoice clearly stating 'Temporary Import'. This must be written

in the General Description section and the Detailed Description of Goods. (see sample)

- The goods arrive and leave in the same condition, i.e. they undergo no

repairs nor are they used in manufacturing

- Stay no longer than the period listed above

- Include your ATA Carnet with your shipment (if applicable)

- Include the expected return date or the date that it was originally received

within the country (whichever applies)

- Any above listed items not listed in this checklist

Sources:

http://www.douane.gouv.fr/articles/a10858-regime-particulier-l-admission-temporaire

https://ec.europa.eu/taxation_customs/specific-use_en

https://acrosslogistics.com/blog/en/temporary-importation

Sample Commercial Invoice for Temporary Imports

| Ship To | Invoice |

|---|

Paris Tradeshow

Charles de Gaulle

1 Avenue Montaigne

Lille

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Temporary Imports - Trade show booth and display equipment returning Jan 2020

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 box | Temporary Imports - Trade show booth and display equipment

| CA | $1032.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Temporary Imports

Contact Name: James Smith

| Total Invoice Amount: $1032.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Occasional Shipper to France

If you ship occasionally to France (i.e. items you sold on eBay),

there isn’t too much you need to do. You will need to:

- Include 3 copies of the Commercial Invoice with your shipment

- Provide a detailed description of the goods on the Commercial

Invoice (in order to avoid customs delays).

NOTES: No EORI number needed if you are shipping as a private individual

Regular Shipper to France

If you regularly ship sold goods into France, we recommend you consult

with a licensed customs broker in France. There may be some

requirement that you will need to comply with such as obtaining an Economic Operator Registration and Identification (EORI) number.

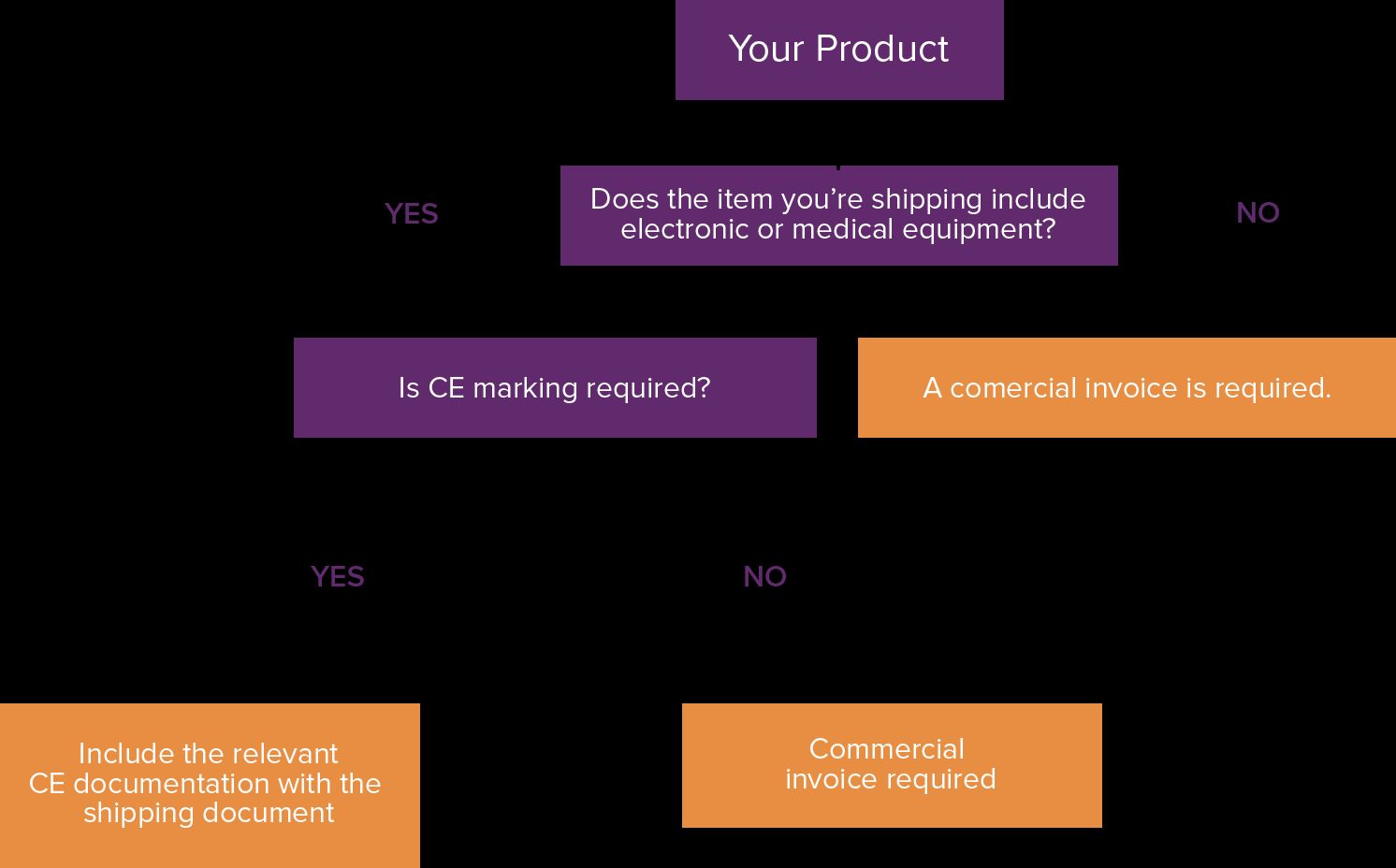

CE Markings for Shipments to France

As France is part of the EU (European Union), certain products require

CE (Conformité Européene) markings to be allowed entry into the

country. This is generally for electronic equipment or Medical

equipment. More information can be obtained here.

Do I need a CE marking in addition to my commercial invoice and other

standard export documents? Sources:

https://www.tradecommissioner.gc.ca/france/market-facts-faits-sur-le-marche/7684.aspx?lang=eng.

http://www.douane.gouv.fr/articles/a13068-economic-operator-registration-and-identification-eori-number

https://www.rsm.global/france/en/insights/corporate-literature/selling-and-transferring-french-real-estate

Sample Commercial Invoice for Permanent/Sold Goods

| Ship To | Invoice |

|---|

Charles de Gaulle

Charles de Gaulle

1 Avenue Montaigne

Lille

France

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Permanent/Sold: Parts and accessories for Canon B78n camera

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 15 Each | Camera Lenses: Canon EF 50mm, Canon EF 85mm & wide-angle lenses.

| CA | $132.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent/Sold

Contact Name: James Smith

| Total Invoice Amount: $1980.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Import duty and taxes in France are calculated based on the sum of the

Customs Value, Insurance Amount, and Freight costs (shipping costs).

This is known as CIF.

Using the CIF Value, you can predict how much Duty & Tax the recipient

would have to pay the French government to receive their goods.

Thresholds

Some countries provide a Duty & Tax Threshold (i.e. de minimis) which

means that below a certain CIF amount, no duties or taxes are charged

on the import of that shipment.

NOTE: Alcoholic beverages, perfumes, and eau

de toilette are always subject to VAT, duties, and excise taxes.

| Currency | Euro (EUR) - € |

| TAX (VAT) | 20% - Almost all products

10% - For some services

5% - Agricultural and food products

2.1% - Medicine |

Duty Exemption

(De minimis value) | €150 |

Tax Exemption

(De minimis value) | €0 - effective July 1st, 2021 |

| Threshold Method | CIF |

| Tax & Duty Calc Method | CIF |

| |

Duties on Imports

- Candy0%

- Chocolate0%

- Spirits and Wines0%

- Tobacco0%

- Books 10%

- Documents0%

- Video Games & Consoles0%

- Computers & Laptops0%

- Tablets0%

- Mobiles0%

- Cameras0%

- Accessories for Electronics5%

- Coats10%

- Beauty Products & Cosmetics0%

- Jewellery0-4%

- Shirts & Pants10%

- Home Appliances2%

- Toys0%

- Sports Equipment3%

NOTES: The numbers above are based on the item’s Country of Origin (manufacture)

being a part of the Most-Favored Nation (MFN). If the Country of Origin

is a member of the World Trade Organization (WTO), then it is part of the

MFN and hence gets the above Duty rates. Please keep in mind that we do

make an effort to keep the numbers above updated, but if exact numbers

are needed, please contact a customs broker at the destination company

Sources:

https://customsdutyfree.com/france-customs-and-import-duty-tax-calculation-method/

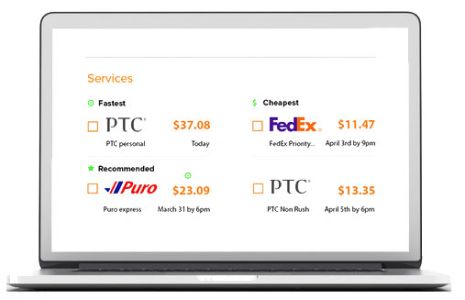

In order to figure out the cost of a shipment to France, you must first

know the following information: delivery address information, weight,

dimensions. Other factors will also affect the price such as delivery

options, insurance and service level.

You can visit our online estimate tool to get real-time rates on shipments to France. Keep in mind that the more accurate your information is, the more

detailed your quote will be.

How much does it cost to courier an envelope from Canada to France?

The cost to courier an envelope from Canada to France will depend on the

carrier you select, as well as the service level you choose. The faster

your envelope needs to be there, the higher the cost will be. Find

competive shipping rates through different carriers such as FedEx, UPS,

Purolator & Canada Post by using the Secureship platform.

You can use our multi-carrier online shipping platform to find the

service, rate and carrier of your choice to send your envelope from Canada to France.

How much does it cost to send a package or box internationally to

France?

The shipping cost of a box or a package to France will depend on the

destination city, size, weight, service level, insurance and any

additional service options.

The most effective way to find the price to send a box from Canada to France is to get a real-time quote by using our estimate tool.

What is the cheapest way to ship a package to France?

The cheapest way to ship a package to France is to use a rate shopping

platform like Secureship. You have access to multiple trusted carriers

to choose from while comparing different prices and service levels.

Above all, you will be able to save over 50% off the carrier published

rates.

Find the cheapest way to ship your package to France through Secureship by visiting our instant online shipping cost calculator!

Does USPS ship to France?

Yes, USPS (not to be confused with UPS listed below) does ship to France

with some restrictions. Their services range from 1-10 business days for many major markets.

The actual number of days will vary according to the origin location and

customs delays.

You can find out more by visiting this link: https://postcalc.usps.com/

How long does it take to ship to France from Canada?

You can have your parcels picked up and delivered between 2-5 business

days through the express carriers available on the Secureship platform.

More economical services, such as Canada Post, can take up to 2 months

to complete the delivery.

Find out how fast the Secureship trusted carriers can get your shipment

delivered to France by getting a quote now.

Is there Economy/Overnight shipping to France?

Economy shipping options to France are available with the carriers on

our system with delivery times ranging from 3-6 business days. There is

no Overnight shipping services to France however, there are express

services that offer delivery within as little as 2 business days.

The delivery times provided by the carrier are based on ideal conditions

and do not take into account weather, customs, or other conditions

beyond the carrier's control.

Visit our shipping estimate tool to find all the delivery options and costs

available to France. As a bonus, if you ship your package with Secureship, you can save

over 50% on the cost of shipping due to our group buying discount.

Who ships envelopes or small boxes to France from Canada

There are a variety of carriers that provide shipping services for

Envelopes and Boxes to France from Canada including FedEx, UPS,

Purolator, DHL, Aramex and a few more.

The cost and delivery time can vary wildly between all the carriers that

offer these services. To make things easier for you, we've created an

online shipping estimate tool that will help you get all the Express, Priority and Economy delivery options and prices to France.