Duties and Taxes

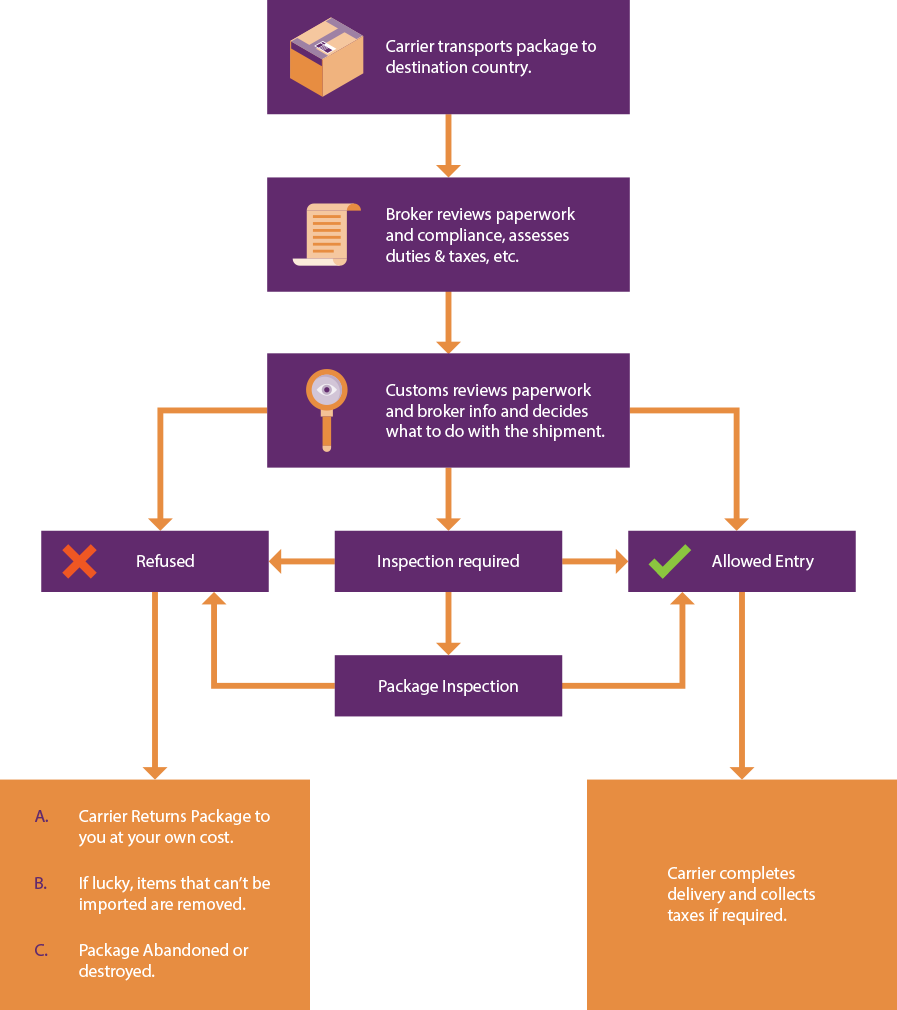

While the sender is required to submit accurate and complete documentation accompanying a shipment, the receiver is generally the one responsible for any duties and taxes related to the package, and you should expect these to be charged upon delivery. There are some exceptions to this rule, which you can learn more about in Shipping 208. In general, the importing process works as shown:

If you need to determine the costs associated with a given shipment, Shipping 203 is a good place to start, as it covers some of the main fees and taxes along with the best ways to estimate them. As the importer, you'll also need to consider brokerage and the associated fees, which we'll explain below.

Brokerage

It's the receiver's job to assign a broker, but this is often much simpler than it sounds. The vast majority of the time, your shipments can be cleared by the carrier's broker, making things easier for you and removing one step from the importing process. Your carrier should make this process as simple as possible, but it's still helpful to have an understanding of how brokerage works.

Power of Attorney

Power of attorney is another important aspect of importing. In order to have a broker clear your packages on your behalf, you have to sign a document assigning them power of attorney. Your carrier will typically provide this form as part of the shipping process, and it's involved with a high percentage of international shipments.

You can sign over power of attorney either on a one-time basis or as part of an ongoing arrangement.

De Minimis Value

The de minimis value represents the minimum value a product must have in order for duties and taxes to be applied. Currently, the de minimis value is $20 in Canada, $300 in Mexico, and $800 in the US. If your shipment is below the applicable figure, no formal customs procedures are required and no duties or taxes are required.

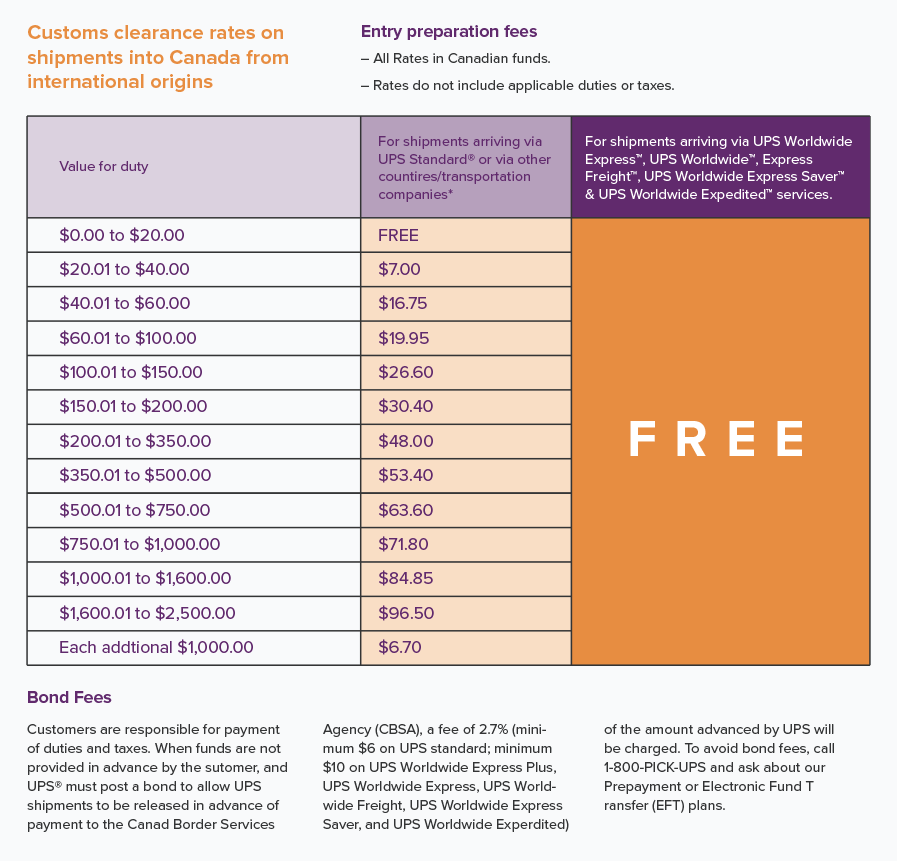

Brokerage Fees

Depending on your country and shipping volume, brokerage fees can add up over time. Using UPS , for example, to import a product worth between $1250 and $2500 to the US, leads to a charge of $40.50 according to the chart below. If you're regularly importing valuable shipments, this can be a significant expense, which may lead you to look for a new broker.

If, however, you can't find a firm suitable to your business's needs, you can self-clear your items through customs, which is outlined below or select a different broker.

Selecting a Broker

If brokerage fees are a significant concern for your business, you can easily find a number of different brokers to help you with your imports. Each one will have different pricing structures but from what we've seen, going with a non-carrier broker can significantly bring down your brokerage fees. They can often provide more personalized service and clear items that require special attention such as Temporary Goods. Remember, when looking for a broker, you want to find brokers that are located at the destination country of your shipments. For example, if you are importing a lot of packages into Canada, you'll want to find a Canadian Customs Broker. The same applies to the United States and other countries.

Self-Clearing

If you'd rather not be responsible for brokerage fees, you do have the option of self-clearing rather than using a broker. This typically involves going to the location of first import and clearing the items yourself, so it may or may not be worth it depending on the cost of brokerage and your proximity to a customs office.

Self-clearing can be an intimidating task, as professional brokers have extensive experience with the customs process and related forms. We'll try to guide you through the details here.

How to Self-clear

Before you can start self-clearing your shipment, you must first advise the shipping company (ie. FedEx, UPS, DHL) that you want to self-clear the shipment. Once your shipment arrives to the carrier's warehouse within your country, you can make your way to the local customs office and start the self-clearing process. You'll need to grab the following documents prior to heading down. You can find a list of Canadian Border Services offices here .

- Copy of the Shipping label, waybill, or manifest: These documents are important because they customs needs to know which packages to release. You can get any of these documents from the shipper.

- The commercial invoice, and possibly a proof of payment, is necessary for customs to determine how much to charge you in duties and taxes.

You'll need to take both of these forms to the customs office nearest the facility at which your products are being stored, where you'll pay any associated duties and taxes. You may be required to show a valid form of ID.

Once you've gotten your manifest stamped at the customs office, you can take it to the carrier and present it in order to retrieve your package.

When Not to Self-clear

While self-clearing can be a great way to reduce costs, there are some situations in which it's likely easier to allow a professional to handle your brokerage. If you're importing cargo, or if you don't have a customs office nearby, the inconvenience of having to navigate those issues on your own likely isn't worth the money you'll save.

Registering to Self-clear

If you're self-clearing goods for a business, you'll need to register your business for import with the Canada Revenue Agency (CRA). CRA makes this process super easy but it does take 24hrs for it to take into effect. Start this process by calling them at 800-959-5525.

Importer of Record

The Importer of Record is the person or business responsible for paying the duties and taxes on an imported shipment. It's typically the person receiving the goods but the Importer or Records can be assigned to someone else when indicating the "Sold To" party.

Regardless of whether you choose to self-clear or hire a broker, the Importer or Records is responsible for any duties and taxes applicable to the goods for up to six years after the year of the import. The Canada Border Services Agency therefore advises keeping all records pertaining to the import for six years-this includes price paid, quantities received, vendor, country of origin, product, and any other relevant information.

Summary

In the vast majority of situations, your best option should be having your carrier's broker clear your shipment, as they have the knowledge and expertise to make sure everything goes smoothly at little cost to you.

However, if you'd rather take on that responsibility, you do have the option. If this is something you're interested in, we recommend doing independent research to learn the ins and outs of international shipping (starting with the learning center here at Secureship).

Next up is Shipping 208, which covers the Incoterms that describe different arrangements for import and export.