Who will pay for the shipping? What about the insurance? Up to what point? How about duties and taxes? Am I responsible to clear the goods or are you? These are all great questions and are especially important when settling the terms of sale with a buyer of your product.

Incoterms were created to solve this problem. They describe who is responsible for what fees and where their responsibility stops. Since the Incoterms are globally recognized and identical everywhere, there is no risk of misunderstanding between local laws.

This article will give you a place to start by covering the basic

international commercial terms.

In case you're wondering, once you've figured out the Incoterm that applies to

you, you'll also need to indicate that on your commercial invoice.

General Information about Incoterms

Incoterms are used to standardize the most common types of terms for trading, making it simple for importers and exporters to reach an agreement. They are typically made up of three letters, which can make them confusing if you're unfamiliar with the terminology. You've probably heard of FOB or DDU and if not, we'll get into what they mean later in this article.

In general, the Incoterms are applicable for freight shipments, rather than small or personal packages that you would send with courier companies such as FedEx, UPS, DHL, Aramex, etc. It's important to understand what each one means so that you can make an informed decision. Different arrangements may be better depending on the industry, countries of origin and destination, and other factors.

List of Incoterms

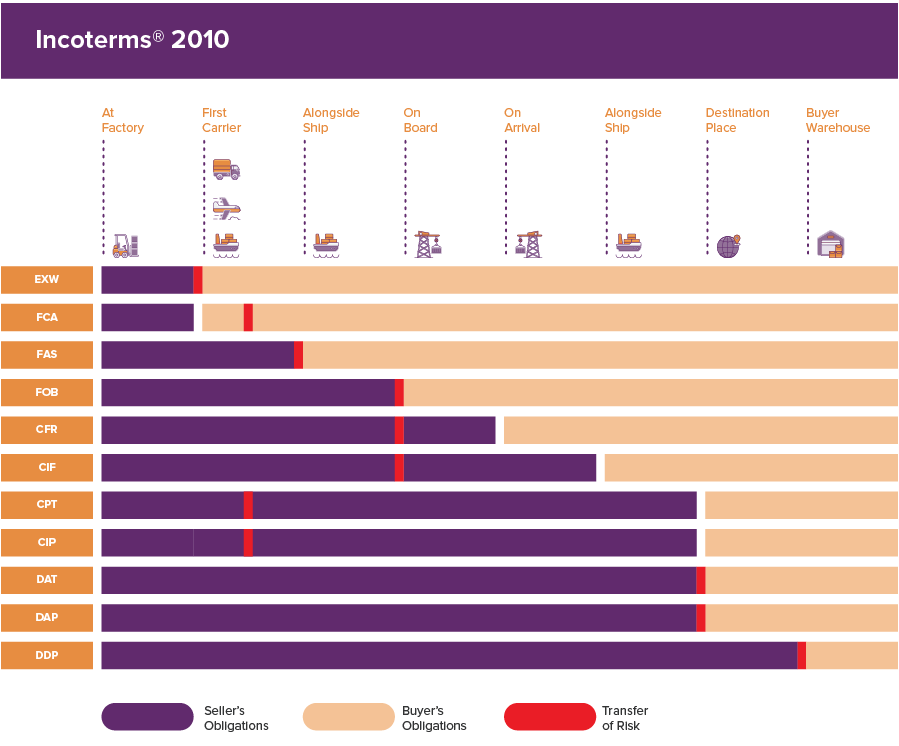

This list starts with Ex Works, which comes with a high level of responsibility for the Buyer (importer), and finishes with Delivery Duty Paid, which places the highest obligation on the Seller (shipper). The helpful graphic at the end of the article provides a simple visualization of the different terms and indicates where liability changes hands.

![]() 1. Ex Works (EXW)

1. Ex Works (EXW)

Ex Works has substantial liability on the side of the Buyer in comparison to the Seller. It's the Buyer's job to bring the goods from the Seller to their final destination, which includes loading them at the origin, clearing them for export, and paying duties and taxes. Ex Works is often used to represent the sale price of a product without including any of the associated costs.

![]() 2. Free Carrier (FCA)

2. Free Carrier (FCA)

With Free Carrier (FCA) shipments, liability changes hands at a named place rather than at delivery or loading. The Seller is typically responsible for bringing the goods to that location and clearing them for export, with the Buyer responsible for unloading and finishing delivery. If that place is the Seller's premises, then it's the Seller's responsibility to load the goods.

![]() 3. Free Alongside Ship (FAS)

3. Free Alongside Ship (FAS)

The Free Alongside Ship (FAS) term requires the Seller to deliver the goods up to the vessel or ship. The Buyer is then responsible from that point on, including making arrangements for the items to be loaded onto the ship. The Seller is generally expected to take care of clearing the items for export, not to be confused with clearing the items for import. By that, we mean any special documents that are required prior to the shipment leaving the country must be provided by the Seller. This can be a B13a, SED, or any other government compliance form.

![]() 4. Free On Board (FOB)

4. Free On Board (FOB)

In contrast to Free Alongside Ship (FAS), Sellers who use Free On Board (FOB) are liable for all costs and risks up until the point at which the goods are loaded onto the Buyer's ship. The Seller is also responsible for customs clearance and brokerage fees. The Buyer pays all costs related to transportation, insurance, and unloading.

![]() 5. CFR and CIF

5. CFR and CIF

CFR (Cost and Freight) and CIF (Cost, Insurance, and Freight) both involve the Seller paying the transportation of goods until they reach the destination port. The Buyer, however, is liable for all risk starting when the products have been loaded in the country of export. They are also responsible for all transportation costs after the shipment has reached the destination country.

CIF differs from CFR in that it requires the Seller to purchase insurance for the Buyer while the products are going from the port of export to the port of destination. This means that under CIF, the Seller pays for the transportation of goods, including customs, as well as insurance. They are responsible for liability coverage up to 110% of the value of the goods, which removes the risk assumed by the importer in a typical CFR arrangement.

![]() 6. CPT and CIP

6. CPT and CIP

CPT, which stands for Carriage Paid To, and CIP, which is Carriage and Insurance Paid To, are similar in most respects, but, like CFR and CIF, differ when it comes to the obligation of insurance. In each situation, the Seller is responsible for the costs of delivery until the destination, but the risk during that phase of the shipping process belongs to the Buyer.

Due to this liability, the CIP option requires the Seller to pay for insurance up to the final delivery point, until the goods are delivered to the named place of destination. This allows CPT to work without the conflicting financial responsibility and financial risk implied by a normal CPT arrangement. The insurance should be arranged so as to allow the Buyer, Seller, and any other impacted party to file a claim.

![]() 7. Delivered at Terminal (DAT)

7. Delivered at Terminal (DAT)

Like Carriage Paid To (CPT) and Carriage and Insurance Paid To (CIP), the Delivered at Terminal (DAT) term requires the Seller to pay all costs until the shipment reaches the destination port, but it also requires them to assume liability for all risks during that time and makes them responsible for unloading.

![]() 8. Delivered at Place (DAP) - Formerly Delivered Duty Unpaid (DDU)

8. Delivered at Place (DAP) - Formerly Delivered Duty Unpaid (DDU)

Delivery at DAP is similar to Delivery at Terminal (DAT) with the difference being that the Seller is responsible to make arrangement for unloading the goods and have it delivered to a previously agreement upon location (ie. Named Place) If the Seller is unable to make arrangements for transport to a Named Place, DAT is preferable to DAP.

![]() 9. Delivered Duty Paid (DDP)

9. Delivered Duty Paid (DDP)

DDP shipments put the highest responsibility on the Seller and the lowest on the Buyer. The Seller is required for paying all duties and taxes, as well as obtaining authorization from local agencies, which means that they must be extremely familiar with the local laws and regulations. Therefore, DDP is a relatively unreliable method of shipping and should only be used in specific situations.

Understanding Incoterms

The graphic below is a quick, simple way to understand each of the Incoterms and how they relate to each other.

Summary

Having a complete understanding of the Incoterms is important for making informed decisions about your imports and exports. Different arrangements can lead to significant differences in costs and risks, so you shouldn't take them lightly. Discuss the possibilities with all parties involved and try to reach an agreement that works for everyone.

That's it for now. Stay tuned for more lessons!