Nov 07, 2025 • by Paul Bourque

How much is shipping to Italy from Canada?

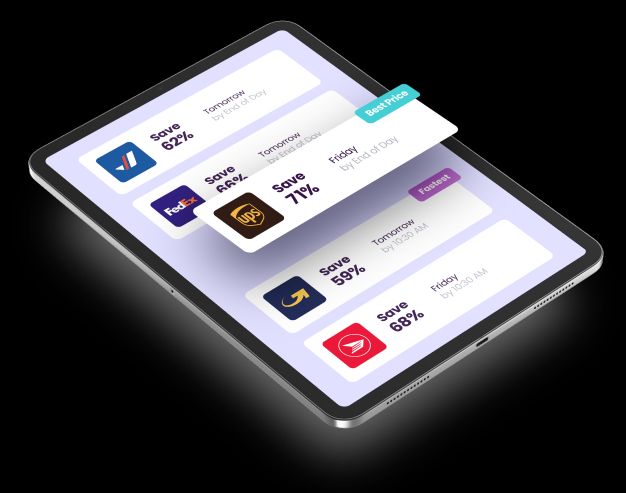

Shipping to Italy can be incredibly expensive, especially for next day service, but shipping broker Secureship finds its clients savings of 50% or more

by Paul Bourque

Feb 12, 2024

Key Points

Canada has a long history as a trading nation, initially because of its vast natural resources, which continues into modern times, but these days its exports also encompasses manufactured goods. Today, Canada is a G7 country of 40 million citizens and is closely connected economically to 40-plus nations through trade alliances spanning the globe. Amongst those countries are the USA, Mexico, the European Union, the Trans Pacific Partnership states, Chile, Peru, Costa Rica, South Korea, and Israel.

While Canada has numerous business links to the outside world, the actual process of getting your goods to those countries can prove challenging. Exporting goods from Canada requires attention to many details, and this blog will cover the basics of several of them – incoterms, documentation (HS codes and commercial invoices), and packaging.

Beyond this blog, Secureship can help you navigate those and many more details to make shipping a smoother and far less expensive chore.

Table of Contents

International commercial terms (incoterms) were created to establish which transportation fees are the responsibility of the seller or the buyer and when the risk and responsibility for the goods ends for one party and starts for the other.

There are 11 Incoterms and each is identified by a 3-letter code, some of which may be identifiable to you like FOB, CIF, DDP. Incoterms are recognized globally and are identical for all countries, so everyone plays by the same rules, and clearly understands what the rules are. Your agreement to an incoterm with a foreign importer can have significant impacts on your costs and risks as an exporter, so it is quite important that you understand what each one means to you and your business.

As this blog only introduces the concept of incoterms, we recommend you consult Secureship’s Learning Centre for further details.

International trade demands a lot of documentation, and two key pieces of paper always required are the HS number for the goods and a commercial invoice for the shipment.

Goods traded between nations are classified and identified using a standardized numeric code that is six - ten digits long. The HS code is used by customs agents and businesses selling and buying products. As an exporter, it is essential for your business to apply the correct HS code to your products. Once determined, the number must be recorded on export documentation, such as the commercial invoice.

The HS code tells customs agents exactly what product is being imported and allows them to levy the appropriate tariffs and ensure local regulations are enforced.

Canadian exporters can access HS codes in a variety of methods as detailed below:

The commercial invoice (CI) is a key document without which your goods will not enter a foreign country. Consider it a passport for the shipment.

The CI describes the goods in the shipment, states their values, and allows customs officials to apply the correct duties and taxes (for example, GST or VAT) on those items. And if the CI is incomplete or incorrect, it could lead to shipping delays, shipment returns, and possibly fines. So, it is very important to ensure that you have identified and recorded all relevant data (including HS codes) before the goods have left Canadian soil.

Once the incoterm for the shipment has been established, the goods’ HS code ascertained, and the commercial invoice completed and checked, packaging the product is your next important task. Packages must be able to endure being dropped, pushed, and piled upon during their journey overseas.

To give the contents the best chance of arriving undamaged, the following tips will go a long way to help:

Further packing details can be found by consulting ISTA 3A packaging standards, which must be followed if insurance against damages has been purchased for the shipment.

Exporting goods from Canada to global markets may seem to be a daunting task as there are numerous details necessary to ensure the goods enter a foreign country smoothly. This blog has introduced and explained the basic points of a few of those important details: incoterms, HS codes, the commercial invoice, and packaging the goods for a safe trip.

So, whether your business is new to exporting goods and international shipping or well experienced, contact Secureship for the cheapest way to ship a package overseas or domestically. In addition, we can help you with the nitty-gritty details that shipping demands, which will save you time and hassles.

Nov 07, 2025 • by Paul Bourque

How much is shipping to Italy from Canada?

Shipping to Italy can be incredibly expensive, especially for next day service, but shipping broker Secureship finds its clients savings of 50% or more

Nov 03, 2025 • by Paul Bourque

What is the cheapest way to ship a package from Canada to Mexico?

Reducing a parcel's size and slowing its delivery are two easy ways to make a shipment to Mexico cheaper

Oct 27, 2025 • by Paul Bourque

Can I ship to France with FedEx?

FedEx's collection of airplanes and worldwide connections ensures regular package deliveries from Canada to France