Nov 07, 2025 • by Paul Bourque

How much is shipping to Italy from Canada?

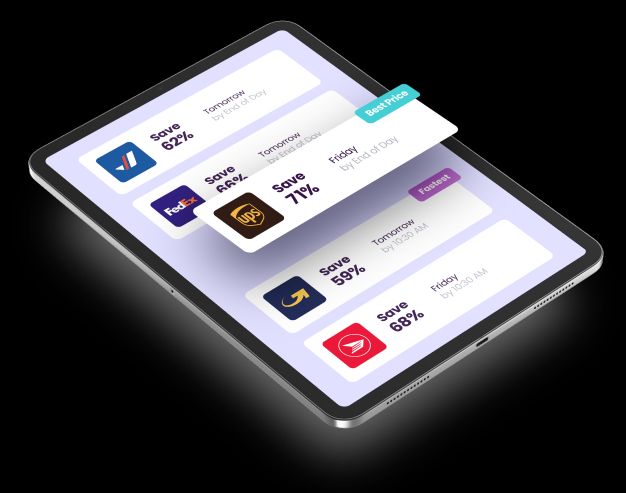

Shipping to Italy can be incredibly expensive, especially for next day service, but shipping broker Secureship finds its clients savings of 50% or more

by Paul Bourque

May 23, 2024

Key Points

Sending a birthday parcel to a relative across Canada is a far different process than shipping the same goods overseas. For starters, foreign nations impose regulations on goods entering from Canada or any other country. Goods may be prohibited, restricted, require a licence, or are liable to duties and taxes.

And depending on the items, customs will also check the incoming goods for:

Though shipping overseas is certainly more complicated than shipping across town, Secureship can offer you help in a variety of ways. Our website has country-specific shipping guides for more than 140 countries, a Guru bot with answers to 5,000-plus questions, a Learning Centre, and dozens of blogs on assorted shipping topics.

Table of Contents

Secureship is a Canadian shipping broker that has for many years helped its customers save time and money on their international and domestic shipments. Their website also offers a plethora of shipping information on a variety of topics, one of which is a series of Country Shipping Guides for 140-plus territories and countries.

For each country, the customs rules and regulations for each of the following types of shipments are outlined:

So, consulting these pages will give you a clear idea of what can be shipped and their limitations – dollar value and quantity of items – before you package goods for shipment.

But much more information is also available for each country, so please read on.

One of the annoying and time consuming aspects of international shipments is paperwork. Secureship’s system helps you through that process, and the following table describes some key pieces of paper and when they are required.

| Document | Description |

|---|---|

| Shipping label/Bill of Lading | A required document so the carrier knows the parcel’s recipient and address |

| Commercial Invoice | Required by customs so that they can correctly assess the goods for duty and tax levies |

| B13a | Required if the shipment’s value is greater than $2,000 CAD or it is a controlled substance, and destined to any country other than the USA, Puerto Rico, or US Virgin Islands |

| Certification of Origin (COO) | Usually required when proof of an item’s manufacturing or processing in Canada is required because of a trade agreement |

| ATA Carnet | Used for temporary imports of goods shipped to countries for trade shows, exhibitions, conferences, etc. |

Two other important areas of concern for shippers to foreign territories are prohibited and restricted goods and duties and taxes.

Prohibited goods are not allowed entry into a country under any circumstances whereas restricted goods may enter but with restrictions to quantities or require a licence or certifications for health and safety reasons.

Virtually all countries prohibit firearms and ammunition; narcotics and drugs like marijuana; counterfeit goods; indecent or obscene material; and various weapons like switchblades. However, countries add to this list based on their cultural or religious practices, so it is best to check Secureship’s country guides to ensure you are obeying all of the laws.

Restricted items almost always include tobacco products and alcoholic beverages; pharmaceuticals; foodstuffs; artefacts and artwork. But similar to prohibited goods, there is a range of items and researching them before shipping may save you some grief.

Depending on the arrangement you have made with the recipient, duties and taxes may be paid by you when the goods are shipped or by the recipient when they arrive in the country. Regardless of whose responsibility, duties and taxes (usually a VAT or GST) must be paid and affect shipping costs either directly or indirectly.

Again, Secureship’s country pages provide those figures, but be advised that the numbers can and do change. So, it is always recommended that you verify with a country’s customs service or the website customs duty free for up-to-date details so that your shipment will enter a foreign nation in a seamless fashion.

Shipping overseas is more complicated than sending a parcel within Canada. There are more forms to contend with; countries impose prohibitions on certain goods, and that varies from one nation to the next; goods may be restricted in terms of their quantity or monetary value; and duties and taxes need to be paid before the goods are released from customs.

So when shipping from Canada to overseas, we recommend you consult Secureship’s Country Shipping Guides to navigate customs regulations. In addition, its website offers other support with an instant help Guru bot; a Learning Centre that teaches you 16 basic and advanced lessons in shipping; and dozens of blogs that address questions on shipping to some of Canada’s common trade partners as well as on general shipping topics.

Nov 07, 2025 • by Paul Bourque

How much is shipping to Italy from Canada?

Shipping to Italy can be incredibly expensive, especially for next day service, but shipping broker Secureship finds its clients savings of 50% or more

Nov 03, 2025 • by Paul Bourque

What is the cheapest way to ship a package from Canada to Mexico?

Reducing a parcel's size and slowing its delivery are two easy ways to make a shipment to Mexico cheaper

Oct 27, 2025 • by Paul Bourque

Can I ship to France with FedEx?

FedEx's collection of airplanes and worldwide connections ensures regular package deliveries from Canada to France