Can I ship to England with FedEx?

FedEx maintains a fleet of over 660 aircraft that traverse the globe to 220-plus territories and countries. So therefore, you can certainly ship to England from Canada with FedEx. But shipping to an international destination is more involved than sending a parcel domestically. Countries impose rules and limitations to imports; goods will be liable to duties and taxes; and special paperwork must accompany the parcel. To the novice shipper, this may all sound complicated and time-consuming, but read on as this blog presents the basics of international shipping so you can get started with minimal fuss.

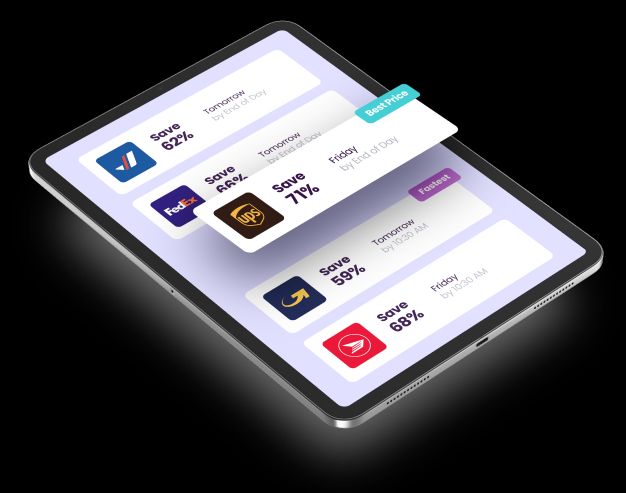

And in the process, we introduce Secureship, a Canadian shipping broker whose online platform allows you to arrange shipping from your home or office, and then have FedEx pick up the parcel at your doorstep. And perhaps best of all, Secureship can save you a lot of money – up to half of your shipping costs.

Table of Contents

- England’s Importation Rules and Regulations

- Duties and Taxes

- Documentation

- Conclusion

England’s Importation Rules and Regulations

Countries’ importation rules and regulations serve to protect the health and safety of their nationals, so a number of goods are prohibited or restricted.

Prohibited and restricted goods

Prohibited goods will not be allowed to enter England while restricted goods may enter but will be limited in quantity or perhaps require permits. Prohibited goods comprise offensive weapons, self-defence sprays, and indecent or obscene materials. On the list of restricted goods, you will find alcoholic beverages, tobacco products, explosives, and firearms and ammunition.

Nevertheless, a range of categories of goods may be shipped to England from Canada, and they include:

- Documents

- Gifts

- Foodstuffs and confectionary

- Personal effects

- Advertising materials and commercial samples

- Temporary imports and repaired goods

- Permanent and sold goods

Duties and Taxes

Duties and taxes are instruments that countries use to protect their local industries and raise government revenues. With a long and friendly trade relationship between Canada and England, many duties on goods are low or non-existent; however, England’s VAT (equivalent to Canada’s GST) applies to all imports regardless of the value of the shipment.

Duties

Typically, duties will be waived if the value of the shipment entering England is £135 or less (about $235 CAD as of June 2024).

Over that value, however, many items from Canada will incur a duty in the 0 - 4% range, but note the exceptions below:

- Tobacco products and spirits and wines (50%)

- Watches (11 - 23%)

- Chocolate and candy (8 - 10%)

- Sports equipment (1 - 15 %)

Taxes

While a de minimis value of £135 exists as a duty exemption on most incoming goods entering England, a 20% VAT fee is charged on all imports even if they have a very low monetary value.

Documentation

Depending on the shipment, a number of different documents may be required for the goods to enter England. The two key ones are the Shipping Label and Commercial Invoice. Beyond that your shipment may also require form B13a, an ATA carnet, or a certificate of origin.

- Shipping Label (aka Bill of Lading): This document states the name and address of the recipient and sender, and it is important that the information is complete and clear to avoid confusion and delayed deliveries.

- Commercial Invoice (CI): For England or any foreign country, no CI, no entry. The CI describes the goods and their quantity so that customs can apply the correct duties and taxes to them.

- Form B13a is required if the value of the shipment is greater than $2,000 CAD.

- ATA carnets are used when shipping temporary imports. They act like a passport for the goods and enable their entry without payment of duties and taxes provided the items leave the country within a specified time period.

- Certificate of Origin (COO): A COO is typically required when a trade agreement exists between two countries to prove that an item was produced or processed in the shipper’s country. Goods with a COO allow them a reduced-duty rate when they enter a foreign country.

Conclusion

As a carrier with a worldwide business, FedEx delivers shipments daily from Canada to England. However, England is a foreign entity with its own laws and set of duties and taxes. So, Canadian shippers must heed those rules and complete all the necessary paperwork to ensure their goods enter the country legally and in a timely fashion so that the recipient receives the shipment as promised.

To help you with a smooth shipment to England with FedEx, or any other carrier, we advise you to consult Secureship, whose 15-plus years of experience guides you through the shipping process and could save you up to 50% on your shipping costs.