Not all types of shipments are created equal. Shipping a television will

require different paperwork, duties, and taxes than shipping an accounting

statement, for example.

Here is a list of the most common types of shipments:

You can also skip ahead to the table containing the list of

Commonly Required Documents.

Note: Australia has no special gift exemption. However, gifts benefit

from the same de minimis threshold as other shipments - items valued under

$1,000 AUD enter duty-free (excluding alcohol and tobacco).

A parcel of gifts shipped to Australia with a total value of 1000 AUD

or less (about $950 CAD) can generally be shipped duty-free provided

the following conditions are met:

- The words "Gift Shipment" or "Unsolicited Gift" are included on the

commercial invoice (see sample)

- Total value of shipment is $1,000 AUD (about $950 CAD) or less

- Each gift is listed on the commercial invoice along with a full

description and dollar value

- Shipments are sent from one person to another (residential address

only), not to, or from a business

- The package does not contain goods that will be sold

- The package does not include tobacco or alcohol

You should know that:

- Prohibited goods are destroyed.

- All gift shipments undergo a screening by the Australian Quarantine

and Inspection Service (AQIS).

- Quarantine inspection fees apply, with a minimum charge of $36 AUD.

- Goods that fail inspection may be treated, destroyed, or returned at

the importer's expense.

Remember, not everything can be imported into Australia. Best to check

the Australian prohibited & restricted section here.

NOTE: Although you can receive a gift duty-free, Australian customs will impose

a 10% Goods and Services Tax (GST) on the gifts entering country.

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Smith Family in Melbourne

James Smith

12 Eccels St

Melbourne

Australia

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal Shipment / Gift Shipment

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Gift Shipment: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $79.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $79.99

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sending Multiple Gifts to Australia

If the parcel contains gifts for more than one person, and the total

value exceeds 1000 AUD, duties and taxes will be imposed. (Australian

Custom law states that the shipment cannot be separated into items for

different people.)

NOTE: Some courier companies such as UPS or DHL charge a Quarantine Processing

Fee for any shipment containing gifts.

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Smith Family in Sydney

James Smith

1 Abbott Street

Sydney

Australia

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Unsolicited Gift: Consolidated Gift Package

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Unsolicited Gift - Roger: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $39.99 |

| 1 Each | Unsolicited Gift - Erica: Handwoven French Canadian Catalogne Blanket

| CA | $49.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $89.98

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sources:

https://www.ato.gov.au/businesses-and-organisations/international-tax-for-business/gst-on-imported-goods-and-services/australian-consumers-importing-goods-and-services#ato-GSTandgifts

http://www.dhl.com.au/content/dam/downloads/au/express/shipping/customs_support/daff_air_express_carrier_fees.pdf

https://www.ups.com/ga/CountryRegs?loc=en_US

https://www.abf.gov.au/buying-online/importing-by-post-or-mail

http://www.agriculture.gov.au/travelling/bringing-mailing-goods/internet

IMPORTANT: UPS Australia does not accept Personal Effects shipments.

Failure to comply results in a Prohibited Item Fee of AUD $406.20 per package.

If you need to ship personal effects, consider using a specialist moving

company or Australia Post instead.

Personal effects refers to shipping your personal belongings to

yourself (because you're moving there), or to relatives or friends

that you will be living with.

Just like all non-document packages, your shipment will need to be

properly declared and will go through Australian customs. Shipping

personal effects requires a commercial invoice and an Unaccompanied

Personal Effects form (UPE). Without it, your shipment will be held at

customs and/or may be charged duties and taxes. Skip ahead to the Personal Effects CheckList for Australia.

The two following categorizes must be met in order to qualify for duty

and tax free exemption:

1. Residency Type

You are:

- Returning to Australia to resume permanent residence; or

- Coming to Australia to be a temporary resident; or

- Temporary may be up to 5 years for students and up to 2 years

for a workplace-based or professional training. More details can

be found here;

- A returning Australian citizen (For example, from holidays); or

- An Australian citizen residing overseas and returning to Australia

temporarily; or

2. Shipment Ownership Requirements

The items in the shipment:

- Belong to you; and

- Were owned and used by you for 12 months or more.* (Goods owned for

less than 12 months will incur duties and Australia's GST (10%)

NOTE: Car parts, commercial goods (i.e. items meant to be sold), alcohol and

tobacco products, including cigars, pipe tobacco, cigarettes do not qualify

as personal effects and would be subject to duties and taxes.

Personal Effects CheckList:

Australian Quarantine and Inspection Service

All shipments undergo a screening by the Australian Quarantine and

Inspection Service (AQIS), including personal effects.

You should know that:

- Prohibited goods are destroyed.

- Quarantine inspection fees apply, with a minimum charge of $36 AUD.

- Goods that fail inspection may be treated, destroyed, or returned at

the importer's expense.

NOTE: Some courier companies such as UPS or DHL charge a Quarantine Processing

Fee for any shipment containing used goods or sporting goods.

Sources:

https://www.abf.gov.au/entering-and-leaving-australia/moving-to-australia/upe

https://www.abf.gov.au/form-listing/forms/B534e.pdf

Sample Commercial Invoice for Personal Effects

| Ship To | Invoice |

|---|

Adelaide Community Centre

James Smith

12 Eccels St

Adelaide

Australia

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal effects being delivered to my new address.

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 5 Pairs | Personal Effects: 5 pairs of various types of shoes

| IN | $40.00 |

| 1 Each | Personal Effects: Arc'terix Winter Jacket

| CA | $478.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Personal Effects

Contact Name: James Smith

| Total Invoice Amount: $678.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Food can be imported into Australia however, Australia imposes strict

procedures to prevent the entry of harmful diseases and pests, and as

a result not all food items can be imported or will have restrictions.

Food, chocolate, and candies can be imported into Australia provided:

- It is a personal shipment

- The items being shipped are commercial product (not homemade)

- Items are factory packaged and sealed

- They weigh no more than 10 kg (22 lbs)

NOTE: It is important to declare food items on your shipment, even if the amounts

are small or are ingredients for cooking. All items need to be factory

sealed and unopened.

Some items you can ship to Australia (provided the above conditions

are met):

- Biscuits

- Bread

- Cakes (excluding cheesecakes)

- Chocolate

- Confectionery

- Coffee

- Maple Syrup

- Vegetable and seed oils

Some items you can ship to Australia but have restrictions or limits:

- Cheese, Butter, and other dairy products

- Dried Herbs

- Honey Products

- Meat Items

- Noodles or Pasta

- Nuts and products containing nuts

- Spices

- Tea / Herbal Loose Tea

- Vitamins and supplements

Of course, there are exceptions to what foods or products can be

imported into Australia. You can find the full list of that can be imported into Australia here.

Duties and Taxes

Food, chocolate and candies valued under $1000 AUD ($950 CAD) enter

the country duty-free (as a low value shipment).

There is however, a 10% Goods and Service Tax (GST) that would be

applied to food items. There are GST exemptions for items such as

milk, water, and fruit beverages. A full list of exemptions can be

found here.

Australian Quarantine and Inspection Service

All shipments undergo a screening by the Australian Quarantine and

Inspection Service (AQIS), including foods.

You should know that:

- Prohibited goods are destroyed.

- Quarantine inspection fees apply, with a minimum charge of $36 AUD.

- Goods that fail inspection may be treated, destroyed, or returned at

the importer's expense.

NOTE: Some courier companies such as UPS or DHL charge a Quarantine Processing

Fee for any shipment containing food.

Sources:

https://www.abf.gov.au/entering-and-leaving-australia/can-you-bring-it-in/list-of-items#

https://www.abf.gov.au/importing-exporting-and-manufacturing/importing/cost-of-importing-goods/gst-and-other-taxes/gst-exemptions

http://www.agriculture.gov.au/travelling/bringing-mailing-goods/internet

Sample Commercial Invoice for Food, Chocolate, Candies

| Ship To | Invoice |

|---|

Jamie Abbott

12 Eccels St

Perth

Australia

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Food Shipment - Assorted chocolate bars in their original manufacturer's packaging

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Nestle Chocolate Bars in original packaging expiring May 2027 (shelf life of 6 months or longer)

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent / Sold

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Commercial samples are those that can only be used for demonstration

purposes. The aim is to encourage people to place orders of the

samples, not sell them.

Samples may be imported into Australia for up to 12 months without

incurring duties providing they:

- are not sold or given away

- disposed of or altered in anyway

Samples of negligible value are exempt of GST.

For your sample to be acceptable to Australian Customs, it should

follow the following guidelines below:

- Only ship one example of any particular sample or item

- Clothing samples must be mutilated (such as applying a red ink stamp

to prevent them from being resold. For shoes, holes may be drilled

into the sole)

- The word "Sample" is stated on the commercial invoice under General

Description and Detail Description of Goods

- State a nominal value for the sample, not its normal wholesale value

on the commercial invoice

- The samples composition must be specified on the commercial invoice

(ie. t-shirt made of 90% cotton/10% polyester, Flag pole made of

100% brass)

Australian Quarantine and Inspection Service

All shipments undergo a screening by the Australian Quarantine and

Inspection Service (AQIS), including samples.

NOTE: Some courier companies such as UPS or DHL charge a Quarantine Processing

Fee for any shipment containing samples.

Sources:

https://www.abf.gov.au/importing-exporting-and-manufacturing/importing/cost-of-importing-goods/gst-and-other-taxes

https://www.abf.gov.au/importing-exporting-and-manufacturing/importing/how-to-import/temporary-imports

http://www.agriculture.gov.au/travelling/bringing-mailing-goods/internet

https://www.abf.gov.au/importing-exporting-and-manufacturing/importing/how-to-import/requirements

Sample Commercial Invoice for Commercial Sample

| Ship To | Invoice |

|---|

Darwin Bookstore

James Smith

12 Eccels St

Darwin

Australia

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Commercial Sample - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Commercial Sample - Advanced reading copy of Dan Brown's novel.

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Commercial Sample

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Your product can be sent to Australia for repair or repaired abroad

and returned back to Australia. The process is easy in both cases but

does require you to follow the list of steps outlined below.

Items Under Warranty

Generally, products under warranty are exempt from duties and taxes provided

you follow the

complete list of steps below Items No Longer Under Warranty

For items that aren't under warranty or the warranty has expired, you

would have to pay duties and taxes on the repair cost. Here's a

breakdown of how that works:

- Duty is applied to the total cost of the repair; and

- 10% Goods and Service Tax (GST) is applied to the total cost of the

repair + shipping cost.

Sending Product for Repair to Australia:

If you're sending your package for repair to Australia, then the

following requirements must be met in order to

obtain duty-free exemption:

- The words "REPAIR & RETURN" are stated on the commercial invoice

under General Description or Remarks

- Serial/Product number must be indicated under the Detailed

Description of Goods section on the commercial invoice

- Copy of Repair Contract included with all your export documentation

NOTE: Goods that are no longer under warranty for repair would have to pay any

NOTE: Goods that are no longer under warranty

for repair would have to pay any duties and taxes when the shipment returns

to Canada.

Returning Product After Repairs are Completed:

If your product has been repaired in Canada and is being returned back

to Australia, then the following conditions must

be met in order to obtain duty-free exemption:

- The words "REPAIR & RETURN" are stated on the commercial invoice

under General Description or Remarks

- Value of the product INCLUDING the Cost of the

Repair must be indicated under the Detailed Description of Goods section

- Original shipping documents or tracking number from when the item

was first exported to Australia

NOTE: If you don't have the original tracking information or documentation then

the recipient may be charged duties and taxes on the shipment.

Sources:

https://www.abf.gov.au/importing-exporting-and-manufacturing/tariff-classification/current-tariff/schedule-4#samp

https://www.abf.gov.au/importing-exporting-and-manufacturing/importing/cost-of-importing-goods/gst-and-other-taxes

https://www.ups.com/ga/CountryRegs?loc=en_US

Sample Commercial Invoice for Warranty Repair

| Ship To | Invoice |

|---|

Newcastle Repair Shop

James Smith

12 Eccels St

Newcastle

Australia

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Repair and Return - Watch being sent for repair

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Fossil Watch being sent for repair - Model E5, serial # 789456FG7E2 - Repair Cost $76.00

| US | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Warranty Repair

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Certain goods can be temporarily imported into Australia without

paying duties and taxes provided the goods leave the country within 12

months and a few other conditions are met.

The Australian Border Force (ABF) evaluates whether a shipment

qualifies as a temporary import based on the nature of the goods, what

it will be used for, and who is importing it. Here are certain classes

of goods that can qualify for temporary import:

- Goods imported for display or use at events, fairs and exhibitions

- Specialised equipment or tools to be used in exploration,

production, manufacture

- Goods that will be used to test and evaluate the operation of other

goods etc.

Qualifying for Duty & Tax Free Temporary Import

In order to import your goods duty and tax free into Australia, you

can pick from 1 of the 3 Temporary Import Methods listed below.

Each option has its pros and cons. Regardless, each of the following

methods requires you to complete a Commercial Invoice (CI). More

details below.

| Option # | Temporary Import Method | Risk of paying |

|---|

| 1 | Commercial Invoice Only (no other documentation is provided) | High - if broker cannot clear goods temporarily |

| 2 | Commercial Invoice + Apply for Temporary Import Security | Very Low |

| 3 | Commercial Invoice + ATA Carnet | Very Low |

| 1. Complete a Commercial invoice only

This is the simplest and quickest option. See example.

NOTE: You should be aware that

shipping using this method doesn't guarantee that your items

will be imported duty/tax free. Not all brokers will clear

goods as temporary imports (i.e. UPS, Fedex, DHL) nor is it

a guarantee that customs won't charge any duties and taxes.

2. CI + Apply for Temporary Import Security In addition to completing a Commercial Invoice (CI) you can

also apply for a Temporary Import Security (TIS). This must

be done prior to shipping. In order to apply for a TIS: - Complete Form 46 or Form B46AA (beyond the scope of this article)

- Complete Form 1483 or Form 1484 (beyond the scope of this article)

- Send the completed form, copies of the commercial

invoices, shipping label/air waybills, and any other

applicable export documents (i.e. licenses, permits) by

email to ntis@customs.gov.au (preferred method) or by fax

to 07 3835 3494

- Wait for approval and further instructions

If Australian Customs accepts your shipment for a TIS, you

may be required to put a security deposit down if the value

of the shipment is under $50,000 AUD (about $47,500 CAD). You will be required to put a security deposit if the value

is $50,000 AUD or more. The Security Deposit is equal to the amount of duties and

taxes that would be charged onto the shipment if the goods

were not classified as temporary import. Getting Your Security Deposit Back In order to get your security deposit back, you must contact

Australian Border Force (ABF) prior to exporting your goods.

They will verify that you are exporting the goods prior to

the deadline. ABF contact information can be found here:

https://www.abf.gov.au/help-and-support/contact-us 3. CI + an ATA Carnet This option is great for items that frequently travel in and

out of the country. It's also great because once you have an

ATA Carnet, it is accepted by 176 countries worldwide making

the application process a one-time thing. In addition to declaring your commercial invoice as a

temporary import, you can get an ATA Carnet for the items

that are of temporary nature. ATA Carnets are beyond the scope of this article. You can

however, contact your local chamber of commerce and they

will be able to guide you along. You can also find more

information here: http://www.chamber.ca/carnet/ |

In addition to 1 of the 3 items above, the following conditions must also be met in order to qualify for a duty and GST free exemption:

- The goods must be exported before the end of 12 months

- The goods may NOT be sold, mortgaged, hired, disposed of, loaned or

altered in any fashion without permission of the authorities

- The words "Temporary Import/Not for Resale" are stated on the

commercial invoice under General Description.

- The words "Temporary Import" and the anticipated return date are

stated on the commercial invoice under the Detail Description of

Goods (for all applicable items)

- Include the original tracking number and the import date if the

product is returning

NOTE: - If the above conditions are not followed, duties and taxes will be

charged as though the goods have been imported permanently.

- Your Customs broker can clear goods of a temporary nature (FedEx,

UPS, DHL, etc. typically cannot)

Sources:

https://www.abf.gov.au/importing-exporting-and-manufacturing/importing/how-to-import/temporary-imports

https://www.abf.gov.au/help-and-support-subsite/CargoAdvices/2012-01.pdf

Sample Commercial Invoice for Temporary Imports

| Ship To | Invoice |

|---|

Sydney Tradeshow

James Smith

1 Abbott Street

Sydney

Australia

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Temporary Imports - Trade show booth and display equipment returning Jan 2027

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 box | Temporary Imports - Trade show booth and display equipment

| CA | $1032.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Temporary Imports

Contact Name: James Smith

| Total Invoice Amount: $1032.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Generally, all goods exported to Australia will incur duties and taxes

with the following exemption:

- If goods are valued at equal to or less than 1000 AUD (about $950

CAD), then no duties or taxes are due (DOES NOT apply to alcohol and tobacco products)

If you are a frequent exporter to Australia, it is strongly

recommended that you speak to a licensed customs broker prior to

shipping.

Licenced Australian customs brokers can be found at the links below:

Sources:

https://www.abf.gov.au/buying-online/importing-by-post-or-mail

https://www.abf.gov.au/importing-exporting-and-manufacturing/importing/how-to-import/import-declaration

https://www.abf.gov.au/form-listing/forms/b650.pdf

https://www.abf.gov.au/form-listing/forms/b374.pdf

Sample Commercial Invoice for Permanent/Sold Goods

| Ship To | Invoice |

|---|

James Smith

12 Eccels St

Melbourne

Australia

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Permanent/Sold: Parts and accessories for Canon B78n camera

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 15 Each | Camera Lenses: Canon EF 50mm, Canon EF 85mm & wide-angle lenses.

| CA | $132.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent/Sold

Contact Name: James Smith

| Total Invoice Amount: $1980.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

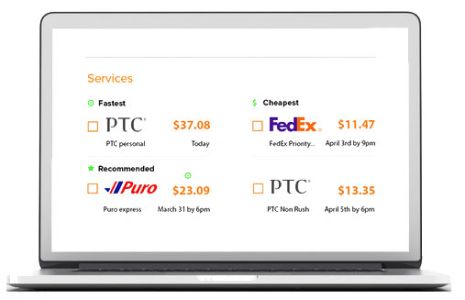

What does it cost to ship to Australia?

The cost to ship to Australia will vary based on the weight, size, and destination city within Australia.

Obtain real-time price comparisons for parcels to Australia by visiting our shipping calculator here.

What is the cheapest way to ship to Australia from Canada?

You can find the cheapest way to ship to Australia by using the Secureship platform to get a price comparisons with all the major carriers. You can then save even more (up to 50% off the list price of the carrier) by shipping your boxes through Secureship because of their group buying power. Find the cheapest way to ship to Australia here.

Does FedEx ship to Australia?

Yes they do. FedEx has a few shipping options to Australia such as International Priority or International Economy.

To find out cost and delivery times, simply use the Secureship Instant FedEx Shipping Cost Calculator found here. Secureship provides preferred pricing with FedEx so you can save up to 50% off the FedEx list price by shipping your parcels directly with Secureship.

Does UPS ship to Australia?

Yes they do. You can send your boxes with UPS through Secureship and save up to 50% off the list UPS price. Get an Instant Rate Quote to Australia with UPS here.

Does Canada Post ship to Australia?

Yes they do. Delivery times will vary depending on the service level you choose. Priority Worldwide (provided by FedEx) can have your package delivered as early as 3 business days. Small Packet Air generally takes 6-10 business days and Small Package Surface takes 2-3 months for your boxes to be delivered. See delivery times with all major carriers here.

What is the best way to ship to Australia?

Shipping internationally can be very difficult so it is recommended you use a platform like Secureship that is designed to help shipper's of all levels. The Secureship platform will guide you through best practices around shipping to various countries, including Australia, and help you find the best way to ship your packages there.

Is there express shipping to Australia?

The carriers on the Secureship network do provide express shipping options to Australia. Pickups and deliveries can happen in as little as 3 business days. View all express shipping options to Australia.

What can I send to Australia?

The list of items that can be shipped to Australia changes often so it's always best to check the official customs page here. A summary of what is prohibited and restricted can be found above.

How long does it take to ship from Canada to Australia?

Delivery times will vary by company and delivery option chosen. You can have your parcels delivered as early as 3 business days with 5-8 business days as the standard delivery time-frame. There are slower and more economical services such as the post office but they can take as long as 2-3 months to deliver your items. See delivery times for shipments from Canada to Australia here.