Not all types of shipments are created equal. Shipping a television will

require different paperwork, duties, and taxes than shipping an accounting

statement, for example.

Here is a list of the most common types of shipments:

You can also skip ahead to the table containing the list of

Commonly Required Documents.

Most documents can be shipped to India duty-free, though there are

certain items that incur a 10% duty charge. See the table below for

these and other restrictions.

| Document Type | Restriction |

|---|

| Airline Tickets | Airline tickets are only classified as a document if issued to

an individual. |

| Brochures and Catalogues | 10% duty charged |

| Calendars | 10% duty charged |

| Computer software (printed hard copy). | 10% duty charge |

| Envelopes (blank) | Maximum of 10 envelopes in a shipment (extras are charged

duties) |

| Greeting and wedding cards | 10% duty charged |

| Pamphlets, booklets and leaflets | 10% duty charged |

| Photographs, printed pictures and posters | 10% duty charged |

| Plans and drawings such as architectural, engineering and

industrial | 10% duty charged. |

| Traveller's Cheques | To be classed as a document, only used traveller's cheques can

be shipped. If the traveller's cheques are unused, they are

classified as non-documents and charged duties. |

Sources:

http://www.cbic.gov.in/resources//htdocs-cbec/customs/cst1718-010718/Chapter%2049.pdf;jsessionid=60B17F8F86043F854C10B0854035A4AA

https://www.ups.com/ga/CountryRegs?loc=en_US

Shipping a gift to India from Canada will incur duty and taxes. There

are no exemptions.

The customs duty charged on a gift shipment will be 77.28% -

calculated as follows: 35% Basic Customs Duty (BCD) plus 10% Social

Welfare Surcharge (SWS) plus 28% Integrated Goods and Service Tax

(IGST).

1. Gifts may include life saving drugs and medical equipment. They

will not be charged duty.

2. Gifts can be shipped and accepted by individuals, societies,

corporate bodies and institutions like colleges and schools, BUT they

are intended for an individual's own use.

NOTE: Be aware that a number of restricted and prohibited goods cannot be sent

as gifts. Gifts containing restricted or prohibited goods, unsolicited

or not, may be confiscated and the receiver may be financially penalized.

Gift Checklist

- A commercial invoice must be included with your shipment

- The words 'Gift Shipment' or 'Unsolicited Gift' are included on the

commercial invoice, even if the shipment is sent at Christmas time (see sample)

- List the items in the parcel and write the value of each

- Sending more than one gift in the parcel? Wrap and tag each one

individually.

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Rabindranath Tagore

Jorasanko Thakur Bari

6/4 Dwarakanath Tagore Lane Jorasanko

Kolkata, India

700007

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal Shipment / Gift Shipment

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Gift Shipment: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $79.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $79.99

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sending Multiple Gifts to India

Be sure to:

- Words "Unsolicited Gift: Consolidated Gift Package" appear in

General Description of Goods as well as the Detailed description of

goods (see sample)

- Individually wrap and tag each gift separately

- Ensure the names on each tag are different and clearly marked on the

commercial invoice

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Rabindranath Tagore

Jorasanko Thakur Bari

6/4 Dwarakanath Tagore Lane Jorasanko

Kolkata, India

700007

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Unsolicited Gift: Consolidated Gift Package

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Gift - Roger: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $39.99 |

| 1 Each | Gift - Erica: Handwoven French Canadian Catalogne Blanket

| CA | $49.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $89.98

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sources:

http://www.cbic.gov.in/resources//htdocs-cbec/cs-manual-2012.pdf

http://www.cbic.gov.in/htdocs-cbec/customs/cs-act/formatted-htmls/cs-regu-courier-imexp-2010

http://www.cbic.gov.in/htdocs-cbec/js-menu/imp-cour2

https://taxguru.in/custom-duty/duty-on-import-of-gifts-other-goods-for-personal-use-through-courier.html https://www.ups.com/ga/CountryRegs?loc=en_US

Personal effects sent from Canada to India as unaccompanied baggage

will incur a customs duty totalling 77.28% - calculated as follows:

35% Basic Customs Duty (BCD) plus 10% Social Welfare Surcharge (SWS)

plus 28% Integrated Goods and Service Tax (IGST).

Shipped unaccompanied baggage should be collected by the owner within

one month of its arrival in India. A delay of up to one year may be

allowed by the Deputy or Assistant Commissioner of Customs for

circumstances beyond the control of the owner of the goods. However,

the reason(s) will have to be documented.

The used personal and household effects of a deceased person may enter

India duty-free providing:

- A certificate from the Canadian Indian High Commission or Consulate

can be produced certifying the ownership of the effects to the

deceased person.

Moving temporarily

A foreign national may stay in India for a maximum of 6 months in any

12-month period for purposes such as study, religious pilgrimage, or

business.

If personal effects are sent unaccompanied, then duties will be

imposed as listed above.

Only if personal effects are carried by a passenger are they duty-free

- up to a limit of 8,000 INR (about $150 CAD).

Moving permanently

A foreign national moving to India may ship personal effects duty-free

up to the value of 50,000 INR (about $950 CAD).

Indian residents are subject to different duty-free limits than

foreign nationals as the table below shows.

| Time away from India | Duty-free amount |

|---|

| 3 - 6 months | 60,000 INR (about $230 CAD) |

| 6 months - 1 year | 100,000 INR (about $1900 CAD) |

| Minimum of 1 year | 200,000 INR (about $3800 CAD) |

| Minimum of 2 years | 500,000 INR (about $9500 CAD) |

Further details and rules governing each condition may be found by

clicking here.

There are limits to the amount of jewellery that can accompany a

passenger or their personal effects. Specifically, males may bring

into India a maximum of 20 g valued at no more than 50,000 INR (about

$950 CAD) and females are allowed a maximum of 40 g valued at no more

than 100,000 INR (about $1900 CAD).

Further details of prohibitions and restrictions may be found in

Annexures I, II, III, which can be found by clicking here.

Personal Effects Checklist

- Commercial invoice must clearly indicate "Personal Effects" under

General Description or Remarks section.

- List each item in the shipment on the commercial invoice.

- Give each item a fair market value.

Sources:

http://www.cbic.gov.in/resources//htdocs-cbec/cs-manual-2012.pdf

http://www.cbic.gov.in/resources//htdocs-cbec/customs/cs-act/formatted-htmls/bgge-rules2016-ason23may2016.pdf

http://www.cbic.gov.in/resources/htdocs-cbec/guide_for_travellers/guide-to-travellers.pdf

Sample Commercial Invoice for Personal Effects

| Ship To | Invoice |

|---|

Rabindranath Tagore

Jorasanko Thakur Bari

6/4 Dwarakanath Tagore Lane

Mumbai, India

400019

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal effects being delivered to my new address.

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 5 Pairs | Personal Effects: 5 pairs of various types of shoes

| IN | $40.00 |

| 1 Each | Personal Effects: Arc'terix Winter Jacket

| CA | $478.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Personal Effects

Contact Name: James Smith

| Total Invoice Amount: $678.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Generally, shipping food to India is complicated and most of the

details are beyond the scope of this article. However, there are 2

groups with clear rules:

- Chocolate and cocoa products will incur a duty of 30%

- Candies and confectionery will incur a GST charge of 18%

Foreign Nationals Living in India

A foreign national living in India may import food duty-free. In order

to qualify for duty-free exemption, the following conditions must be met:

- The foodstuffs exclude fruit products and alcohol

- The total value of foodstuffs in a year may not exceed 100,000 INR

(about $1900 CAD)

- The importer pays for the foodstuffs from funds in Canada

Sources:

http://www.cbic.gov.in/resources//htdocs-cbec/gst/FAQ_3RD_Trench_Final.pdf

http://www.cbic.gov.in/resources//htdocs-cbec/customs/cst1819-010219/Chap%2018.pdf

http://www.cbic.gov.in/resources//htdocs-cbec/customs/cst1718-020218/G.E.%20132.pdf

Sample Commercial Invoice for Food, Chocolate, Candies

| Ship To | Invoice |

|---|

Rabindranath Tagore

Jorasanko Thakur Bari

6/4 Dwarakanath Tagore Lane

Kolkata, India

711305

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Food Shipment - Assorted chocolate bars in their original manufacturer's packaging

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Nestle Chocolate Bars in original packaging expiring May 2027 (shelf life of 6 months or longer)

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent / Sold

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Commercial samples are those that can only be used for demonstration

purposes. The aim is to encourage people to place orders of the

samples, not sell them.

Authentic samples (also called bona fide samples) may be shipped to

India as long as the recipient is not being charged, i.e. they are

free.

Commercial samples can be imported duties and tax free provided the

following conditions are met:

- Commercial samples are valued at less than 10 000 INR (about

$190CAD)

- The total value of samples per year should be no greater than

300,000 INR (about $5700 CAD) and not exceed 50 shipments in a year

- Parcels are to weigh no more than 70 kg

- The goods are being provided free of cost to the recipient

Samples of Engineering Prototypes

If the sample is a prototype of an engineering product, then the

importer must produce a certificate from the Export Promotion Council indicating that the samples are required to ensure export orders.

If the sample is valued at 10,000 INR or less (about $190 CAD), it may

enter India duty-free providing it is rendered useless by any

reasonable means.

An engineering sample valued at more than 10,000 INR must:

- have a bond posted with Indian Customs to cover the value of the

duty

- be re-exported to Canada within 9 months

The duty will be refunded when the machinery is exported back to

Canada.

Commercial Sample Checklist

- A Commercial Invoice must be included with your shipment

- Clearly indicate 'Commercial Samples' on the commercial invoice in the

General Description & Detailed Description of Goods (see sample)

- The item shipped has tearing, perforation, slashing, defacing, or has

permanent marking clearing indicating the item as commercial sample

- Add a nominal value for the item(s)

- State on the invoice: SAMPLE(S) FREE OF COST

Sources:

https://www.cbic-gst.gov.in/pdf/igst-exemption-concession-list-03.06.2017.pdf

http://www.cbic.gov.in/resources//htdocs-cbec/customs/cst1617-020217/csgs-67.pdf

http://www.cbic.gov.in/htdocs-cbec/js-menu/imp-cour2

http://www.cbic.gov.in/resources//htdocs-cbec/cs-manual-2012.pdf

https://en.wikipedia.org/wiki/List_of_Export_Promotion_Organisations_in_India

Sample Commercial Invoice for Commercial Sample

| Ship To | Invoice |

|---|

Rabindranath Tagore

Jorasanko Thakur Bari

6/4 Dwarakanath Tagore Lane

Chennai, India

600128

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Commercial Sample - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Commercial Sample - Advanced reading copy of Dan Brown's novel.

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Commercial Sample

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Advertising material includes items that are handed out to promote

products or services.

Advertising items include:

- Brochures and leaflets

- Price lists

- Pamphlets

- Posters

- Calendars and catalogues

- Photographs

Most advertising material sent to India will incur a 10% duty.

Sources:

http://www.cbic.gov.in/resources//htdocs-cbec/customs/cst1718-010718/Chapter%2049.pdf;jsessionid=60B17F8F86043F854C10B0854035A4AA

http://www.cbic.gov.in/resources//htdocs-cbec/cs-manual-2012.pdf

Sample Commercial Invoice for Promotional Material

| Ship To | Invoice |

|---|

Rabindranath Tagore

Jorasanko Thakur Bari

6/4 Dwarakanath Tagore Lane

Bangalore, India

562109

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Promotional Material - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Promotional Material: Not for Resale. Product pamphlets to hand out at trade show.

| CA | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Promotional Material

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sending Product for Repair to Canada

Goods manufactured in India and exported to Canada for repairs will

have duty imposed on them when they are re-imported into India. The

amount of duty incurred will be the total of:

- The fair cost of repairs, including materials required;

- insurance; and

- freight costs, for both directions

Ensure to complete the following:

- The words 'REPAIR & RETURN' are stated on the commercial invoice

under General Description or Remarks

- Write the Serial or Product number under the Detailed Description of

Goods section on the commercial invoice

- Include a copy of the Repair Contract with all your export

documentation

Returning Product after Repairs are Completed:

Goods manufactured in India, or parts of a larger piece of equipment,

are exempt from duty and taxes providing the goods leave India for

Canada within 6 months of their arrival.

NOTE:

- Personal property that was imported to India but returned to Canada

for renovations, repairs, or alterations that are covered by a

warranty are exempt from duty and taxes.

- This applies only if the goods were repaired free of charge.

Ensure to complete the following:

- Write the words 'REPAIR & RETURN' on the commercial invoice under

General Description or Remarks

- In the Detailed Description of Goods section, write the value of the

product and the cost of the repair

- Include the original shipping documents or tracking number from when

the item was first exported to India

Sources:

http://www.cbic.gov.in/resources//htdocs-cbec/cs-manual-2012.pdf

http://www.cbic.gov.in/resources//htdocs-cbec/gst/igst-exemption-concession-list-03.06.2017.pdf;jsessionid=ED0F7781EAF889573C2CEB79A4E0FAE6

Sample Commercial Invoice for Warranty Repair

| Ship To | Invoice |

|---|

Rabindranath Tagore

Jorasanko Thakur Bari

6/4 Dwarakanath Tagore Lane

Hyderabad, India

501323

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Repair and Return - Watch being sent for repair

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Fossil Watch being sent for repair - Model E5, serial # 789456FG7E2 - Repair Cost $76.00

| US | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Warranty Repair

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Temporary importation of certain goods into India, without incurring

duties or taxes, is allowed for a period of up to 6 months. Make sure

to clearly indicate the return date on the commercial invoice.

Goods that are often part of a temporary import include:

- Scientific and professional equipment

- Commercial samples

- Items that will be used or displayed at a fair, exhibition or event

- Tools and specialised equipment required for repairing, exploring,

producing or manufacturing

- Materials and goods to be used during a public exhibition such as a

trade show booth

- Equipment required to evaluate and test the operation of other goods

and equipment

- Theatrical equipment and costumes

- Mountaineering equipment and supplies (does not include alcohol,

cigarettes and tobacco products)

Tourists

Canadian tourists who enter India for a stay of not more than 6 months

in a 12-month period are allowed a duty-free allowance up to 8,000 INR

(about $150 CAD).

Legitimate, non-immigrant reasons for entering India include: touring,

visiting family, a religious pilgrimage, study, sports or recreation,

or business.

Qualifying for Duty & Tax Free Temporary Import

In order to import your goods duty and tax free into India, you can

pick from 1 of the 3 Temporary Import Methods listed below.

Each option has its pros and cons. Regardless, each of the following

methods requires you to complete a Commercial Invoice (CI). More

details below.

| Option # | Temporary Import Method | Risk of paying Duties and taxes |

|---|

| 1 | Commercial Invoice Only (no other documentation is provided) | High - if broker cannot clear goods temporarily |

| 2 | Commercial Invoice + Apply for Temporary Importation Under Bond

(TIB) | Very Low |

| 3 | Commercial Invoice + ATA Carnet | Very Low |

1. Complete a Commercial invoice only

This is the simplest and quickest option. See example.

NOTE: You should be aware that

shipping using this method doesn't guarantee that your items will be

imported duty/tax free. Not all brokers will clear goods as

temporary imports (i.e. UPS, Fedex, DHL) nor is it a guarantee that

customs won't charge any duties and taxes.

2. CI + Apply for Temporary Importation Under Bond (TIB)

In addition to completing a Commercial Invoice (CI) you can also

apply for a Temporary Importation Under Bond (TIB). You will need to

speak to a customs broker in India to obtain this form. You would

then add the TIB number to your Commercial Invoice.

FYI - Customs clearance provided by the major carriers such as

FedEx, UPS, DHL, etc. DO NOT offer special temporary import

clearance.

3. CI + an ATA Carnet

This option is great for items that frequently travel in and out of

the country. It's also great because once you have an ATA Carnet, it

is accepted by 176 countries worldwide making the application

process a one-time thing.

In addition to declaring your commercial invoice as a temporary

import, you can get an ATA Carnet for the items that are of

temporary nature.

ATA Carnets are beyond the scope of this article. You can however,

contact your local chamber of commerce and they will be able to

guide you along. You can also find more information here: http://www.chamber.ca/carnet/

In addition to 1 of the 3 items above, the following conditions must also be met in order to qualify for a duty and VAT free exemption:

- The goods arrive and leave in the same condition, i.e. they undergo

no repairs nor are they used in manufacturing

- Stay no longer than 6 months in India

NOTE:

- If the above conditions are not followed, duties and taxes will be

charged as though the goods have been imported permanently.

- Your Customs broker can clear goods of a temporary nature (FedEx,

UPS, DHL, etc. typically cannot clear goods of temporary nature).

Temporary Imports Checklist

- Commercial Invoice clearly stating 'Temporary Import'. This must be written

in the General Description section and the Detailed Description of Goods. (see sample)

- The goods arrive and leave in the same condition, i.e. they undergo no

repairs nor are they used in manufacturing

- Stay no longer than the period listed above

- Include your ATA Carnet with your shipment (if applicable)

- Include the expected return date or the date that it was originally received

within the country (whichever applies)

- Any above listed items not listed in this checklist

Sources:

http://www.cbic.gov.in/resources//htdocs-cbec/gst/igst-exemption-concession-list-03.06.2017.pdf;jsessionid=ED0F7781EAF889573C2CEB79A4E0FAE6

http://www.cbic.gov.in/resources//htdocs-cbec/customs/cst1617-300616/csge-158.pdf;jsessionid=20802E775150F0667E8400FA61A67E9E

http://www.cbic.gov.in/resources//htdocs-cbec/cs-manual-2012.pdf

http://www.atacarnet.in/faqs.html

Sample Commercial Invoice for Temporary Imports

| Ship To | Invoice |

|---|

Rabindranath Tagore

Jorasanko Thakur Bari

6/4 Dwarakanath Tagore Lane

Ahmedabad, India

382325

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Temporary Imports - Trade show booth and display equipment returning Jan 2027

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 box | Temporary Imports - Trade show booth and display equipment

| CA | $1032.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Temporary Imports

Contact Name: James Smith

| Total Invoice Amount: $1032.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Shipping goods permanently to India is pretty easy. You simply need to

include a commercial invoice and packing list with your shipment.

Duties and taxes will be charged based on a number of factors (see

duties & taxes below).

Sold Goods Checklist

- Include 4 copies of the Commercial Invoice with your shipment

- Provide a detailed description of the goods on the Commercial

Invoice (in order to avoid customs delays).

- Include a Packing list

- Certificate of Origin (if preferential rate of duty is claimed)

Sources:

http://www.cbic.gov.in/resources//htdocs-cbec/cs-manual-2012.pdf.

Sample Commercial Invoice for Permanent/Sold Goods

| Ship To | Invoice |

|---|

Rabindranath Tagore

Jorasanko Thakur Bari

6/4 Dwarakanath Tagore Lane

Delhi, India

110088

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Permanent/Sold: Parts and accessories for Canon B78n camera

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 15 Each | Camera Lenses: Canon EF 50mm, Canon EF 85mm & wide-angle lenses.

| CA | $132.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent/Sold

Contact Name: James Smith

| Total Invoice Amount: $1980.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

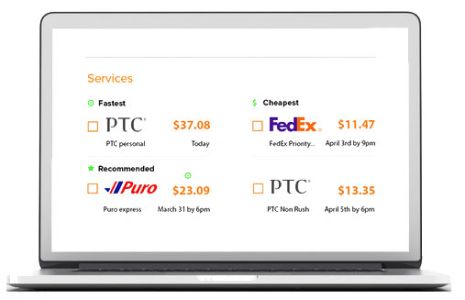

How much does it cost for shipping to India from Canada?

The cost for shipping to India from Canada will be based on your package

information as well as the delivery address. The package information

consists of the destination city, weight, dimensions and other shipping

options if selected.

You can obtain a

real-time price through multiple trusted carriers for your shipment

to India by using our estimate tool.

Does United Parcel Service (UPS) ship to India?

Yes, UPS does ship to India among other countries. The be exact, they

ship to 195 countries and territories in the world. Use Secureship and

start saving today up to 50% off their regular rate.

Get a

Get a UPS shipping estimate to India here. here.

Does FedEx ship to India?

Yes, FedEx ships to India. You can get a quote for shipping your

envelopes or package directly on the Secureship platform. Save up to 50%

on your

FedEx shipment to India

by clicking here.

Does United States Postal Service (USPS) ship to India?

USPS offers shipping services to India. Sadly, they are currently not on

the Secureship platform.

To find out more about shipping to India using USPS, please visit

https://pe.usps.com/text/imm/il_002.htm.

What is the cheapest way to ship from Canada to India?

The cheapest way to ship from Canada to India would be by using the

Secureship platform. You will be able to compare pricing among all the

major carriers and even save up to 50% off their published price.

These huge savings are due to our group buying power. Find the cheapest way to ship to India here.

What are the courier charges from India to Canada?

Courier charges to India from Canada vary widely depending on the size

and weight of the parcel, how quickly it needs to get there and which

courier service you use.

For example, a small box of 2 kg the size of a loaf of bread may cost

from

55 to $300 CAD for express service (4 - 6 days) from Ottawa to

New Delhi.

The best thing to do is to use our estimate tool to get the

courier charges from Canada to India for a variety of providers.

How long does parcel mail take from Canada to India?

Parcel mail using Canada Post, can take as between 12 business days for

Air and 2-3 months for Surface parcel.

You can find out more on their shipping rates and delivery times by visiting

https://www.canadapost.ca/cpc/en/business/shipping/international/compare/international-parcel.page#!navtabd2738e11