Not all types of shipments are created equal. Shipping a television will

require different paperwork, duties, and taxes than shipping an accounting

statement, for example.

Here is a list of the most common types of shipments:

You can also skip ahead to the table containing the list of

Commonly Required Documents.

Most documents can be shipped to New Zealand tax and duty-free

providing the value of the shipment does not exceed $400 NZD (about

$340 CAD).

NOTE: The $400 NZD limit includes the item's

declared value and CIF (Customs Value + Insurance Amount + Freight Costs).

Documents often sent overseas include:

- Company reports and proposals

- Cheques

- Gift cards

- Pamphlets and newsletters

Restrictions for Certain Documents

| Document Type | Restriction |

|---|

| Gift Cards | No more than two pieces and the shipment must be from one

person to another, not to or from a business |

| Greeting Cards and Invitations | No more than two pieces and the shipment must be from one

person to another, not to or from a business |

| Intercompany Data on CD-Rom/Disk | Intercompany data on a CD-Rom does not qualify as a document.

However, intercompany data on disk is classified as a document |

| Photographs | Include the cost of the processing photographs in the value of

the shipment. |

Source:

https://www.ups.com/ga/CountryRegs

Sample Commercial Invoice for Documents Only

| Ship To | Invoice |

|---|

Smith Family in Auckland

James Smith

12 Eccels St

Auckland

New Zealand

+64 3-208 9222

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Documents Only - Business Cards

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Documents Only : 15 Business Cards

| CA | $10 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Documents Only

Contact Name: James Smith

| Total Invoice Amount: $10

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

You can ship a gift to someone in New Zealand duty-free if it is

valued at $110 NZD or less (about $94 CAD) providing:

- The receiver did not order it or pay for it

- It is only for the receiver's personal use

- The words "Gift Shipment" or "Unsolicited Gift" are included on the

commercial invoice (see sample)

- Each gift is listed on the commercial invoice along with a full

description and dollar value

- The package does not include tobacco

Restrictions

A gift can be alcohol, but you must be able to show that it is for a

special occasion, for example, an anniversary. Tobacco, cigarettes,

and cigars cannot be sent as gifts duty-free.

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Smith Family in Christchurch

12 Eccels St

Christchurch

New Zealand

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal Shipment / Gift Shipment

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Gift Shipment: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $79.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $79.99

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sending Multiple Gifts to New Zealand

You can send several gifts to different people in one parcel and

receive the benefits of $110 NZD duty-free for each gift providing you

can prove that the gifts are for different people.

Multiple Gifts Checklist

- Words "Unsolicited Gift: Consolidated Gift Package" appear in

General Description of Goods as well as the Detailed description of

goods (see sample)

- Individually wrap each gift separately and supply a greeting card

- Ensure the names on each tag are different and clearly marked on the

commercial invoice

NOTE: The gift allowance does not apply if there is one gift in the parcel for

multiple people.

Sample Commercial Invoice for Gifts

| Ship To | Invoice |

|---|

Wellington Community Centre

James Smith

12 Eccels St

Wellington

New Zealand

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Unsolicited Gift: Consolidated Gift Package

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Unsolicited Gift - Roger: LEGO Star Wars Rebel UWing Fighter, 659 piece set

| CA | $39.99 |

| 1 Each | Unsolicited Gift - Erica: Handwoven French Canadian Catalogne Blanket

| CA | $49.99 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Gifts

Contact Name: James Smith

| Total Invoice Amount: $89.98

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Sources:

https://www.ups.com/ga/CountryRegs

https://www.customs.govt.nz/personal/duty-and-gst/gifts-inheritance-and-taonga/

If you are returning to New Zealand after more than 21 months, or you

are moving to New Zealand for the first time, then Duties and Taxes

(GST) are not charged on most of your household items.

Conditions and Exceptions

No Duties or GST is charged if items are 6 months or older, except the

following items:

- Any unused or new item

- Commercial items

- Scooters and motorbikes

High risk items include:

- Any shoes and boots (they should be clean of any mud and debris

before shipping)

- Outdoor and/or sports equipment, such as hiking gear and related

equipment

- Wooden items, for example, chopping boards, carvings, picture frames

NOTE: There are a number of items that are considered to pose a high risk to

New Zealand's agricultural economy and its environment. Therefore, they

should be free of bugs, seeds, soil and plant and animal material before

shipping them.

Personal Effects Checklist

To ship personal belongings, you must provide Customs the following

documents:

- A completed copy of: NZCS 218: Unaccompanied Personal Baggage Declaration

- Your passport and documentation that permits you to live in New

Zealand (Work or Student Visa)

- A complete inventory of the items that you are importing to New

Zealand The packing list should be brief with details like: 3 x

jeans, 6 x cotton t-shirts, 2 x pair of running shoes, etc.

Self-Clearing

If your shipment contains only personal and household effects, you may

clear them yourself however, this is beyond the scope of this guide.

Sources:

https://www.customs.govt.nz/personal/move-to-nz-permanently/

https://www.customs.govt.nz/travel-to-and-from-new-zealand/move-to-new-zealand-permanently/household-effects

https://www.immigration.govt.nz/live/resident-visas-to-live-in-new-zealand/permanent-residence/becoming-a-permanent-resident-of-new-zealand/

Sample Commercial Invoice for Personal Effects

| Ship To | Invoice |

|---|

Jamie Abbott

Jamie Abbott

12 Eccels St

Dunedin

New Zealand

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Personal effects being delivered to my new address.

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 5 Pairs | Personal Effects: 5 pairs of various types of shoes

| IN | $40.00 |

| 1 Each | Personal Effects: Arc'terix Winter Jacket

| CA | $478.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Personal Effects

Contact Name: James Smith

| Total Invoice Amount: $678.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Food

New Zealand protects its food and agriculture industry from pests and

diseases by prohibiting or restricting many food products before

entry.

The following is only a guide and not a guarantee that goods will be

allowed to enter the country. This is because rules change quickly and

risky items have to be inspected before being cleared to enter.

Generally, officials will allow in most food that is:

- commercially prepared and packaged

- shelf-stable

- Unopened

From Canada, you are allowed to ship to New Zealand the following:

- Canned meat, but only chicken, spam and corn beef

- Smoked salmon, providing:

- it is gutted, gilled, and headed; and

- in a commercial package; and

- weighs no more than 20 kg

- Dehydrated camping meals in their original and unopened packages

Also, all chocolate, candy, and snack and protein bars are allowed

into New Zealand providing they:

- DO NOT contain liquid honey

- ARE NOT topped with loose fresh fruit or seeds

- DO NOT contain meat or citrus peel

NOTE: Expect that your parcel will be inspected by border officials.

A short list of items that must NOT be shipped to New Zealand include:

- Fresh fruits and vegetables

- Fresh meats and fish

- Honey and other bee products, including inedible items

You should refer here for a complete list of the regulations concerning food and agricultural

products.

Food Duties and Taxes

Food, chocolate and candies valued under $60 NZD ($51 CAD) enter the

country duty and GST free.

There may also be an import transaction fee of $29.26 (about $25 CAD)

and a biosecurity levy of $23.41 NZD (about $20 CAD).

Food Biosecurity Requirements

Parcels are screened by using the information provided on the parcel,

X-rays and detector dogs.

Parcels with food or seed will be opened and examined the Ministry of

Primary Industries to make certain they follow New Zealand's

biosecurity rules and requirements.

Food, Chocolate, and Candies Checklist

- Ensure that your food products comply with the checklist above

- Clearly indicate "Food" on the commercial invoice in the General

Description or Remarks section

- Check with your carrier that they will accept food shipments

Sources:

https://www.mpi.govt.nz/travel-and-recreation/arriving-in-new-zealand/items-to-declare/can-i-bring-or-post-it-to-new-zealand/

https://www.mpi.govt.nz/travel-and-recreation/arriving-in-new-zealand/items-to-declare/can-i-bring-or-post-it-to-new-zealand/food/

https://nzpocketguide.com/what-do-you-need-to-declare-when-arriving-in-new-zealand/

Sample Commercial Invoice for Food, Chocolate, Candies

| Ship To | Invoice |

|---|

James Smith

James Smith

12 Eccels St

Hamilton

New Zealand

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Food Shipment - Assorted chocolate bars in their original manufacturer's packaging

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Nestle Chocolate Bars in original packaging expiring May 2027 (shelf life of 6 months or longer)

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Permanent / Sold

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Commercial samples are items shipped that will be used for

demonstration and marketing purposes. The aim is to encourage people

to buy or place orders.

Small samples of a product may be imported free of Duties and Taxes

providing the goods are marked or damaged such that they are no longer

suitable to sell.

In order to qualify for duty-free exemption, the following conditions must be met:

- The word "Sample" is stated on the commercial invoice under General

Description and Detail Description of Goods

- Is not a dutiable item

- The declared value must be less than $60 NZD (about $51 CAD)

Sources:

https://www.customs.govt.nz/personal/send-and-receive-items/receive-items-from-overseas/

Sample Commercial Invoice for Commercial Sample

| Ship To | Invoice |

|---|

Rotorua Book Store

James Smith

12 Eccels St

Rotorua

New Zealand

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Commercial Sample - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Box | Commercial Sample - Advanced reading copy of Dan Brown's novel.

| CA | $20.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Commercial Sample

Contact Name: James Smith

| Total Invoice Amount: $20.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Advertising material includes items that are handed out to promote

products or services.

Advertising materials are liable for Customs duties and charges,

however shipments valued at less than $60 NZD (about $55 Canadian)

normally do not incur a charge.

In order to qualify for duty & tax free exemption:

- Ensure that the contents of the parcel matches the description on

the parcel Waybill. You may be fined if they are not the same.

- Specify the fair market value or actual costs of the material.

Sources:

https://www.customs.govt.nz/personal/send-and-receive-items/receive-items-from-overseas/

Sample Commercial Invoice for Promotional Material

| Ship To | Invoice |

|---|

Auckland Tradeshow

James Smith

12 Eccels St

Auckland

New Zealand

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Promotional Material - Not for Resale

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Promotional Material: Not for Resale. Product pamphlets to hand out at trade show.

| CA | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Promotional Material

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Shipping goods to New Zealand for repairs is a simple process. Your

product can be sent to New Zealand for repair or repaired abroad and

returned back to New Zealand. Both cases do require you to follow the

list of steps outlined below.

Items Under Warranty

Generally, products under warranty are exempt from duties and taxes

provided you follow the complete list of steps below.

Items No Longer Under Warranty

For items that aren't under warranty or the warranty has expired, you

would have to pay duties and taxes on the repair cost. Here's a

breakdown of how that works:

- Duty is applied to the total cost of the repair; and

- 15% Goods and Service Tax (GST) is applied to the total cost of the

repair + shipping cost + Insurance Amount

Sending Product for Repair to New Zealand:

If you're sending your package for repair to New Zealand, then the

following requirements must be met in order to

obtain duty-free exemption:

- The words "REPAIR & RETURN" are stated on the commercial invoice

under General Description or Remarks

- Serial/Product number must be indicated under the Detailed

Description of Goods section on the commercial invoice

- Copy of Repair Contract included with all your export documentation

NOTE: Goods that are no longer under warranty

for repair would have to pay any duties and taxes when the shipment returns

to Canada.

Returning Product After Repairs are Completed:

If your product has been repaired in Canada and is being returned back

to New Zealand, then the following conditions must be met in order to obtain duty-free exemption:

- The words "REPAIR & RETURN" are stated on the commercial invoice

under General Description or Remarks

- Value of the product INCLUDING the Cost of the

Repair must be indicated under the Detailed Description of Goods section

- Original shipping documents or tracking number from when the item

was first exported to New Zealand

NOTE: If you don't have the original tracking

information or documentation then the recipient may be charged duties and

taxes on the shipment.

Be sure to write the necessary information on the commercial invoice

according to the document checklist below.

Repair Checklist

- Commercial Invoice must clearly state under the General Description

or Remarks section the following: "REPAIR & RETURN" and include the

estimated time of return

- Include repair contract with shipment

- Serial or product number and the cost of repairs should be indicated

under the Detailed Description of Goods section

Sources:

https://www.gov.uk/guidance/temporary-admission-customs-technical-handbook

Sample Commercial Invoice for Warranty Repair

| Ship To | Invoice |

|---|

Wellington Repair Shop

12 Eccels St

Wellington

New Zealand

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Repair and Return - Watch being sent for repair

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 Each | Fossil Watch being sent for repair - Model E5, serial # 789456FG7E2 - Repair Cost $76.00

| US | $163.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Warranty Repair

Contact Name: James Smith

| Total Invoice Amount: $163.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

Goods that are shipped to New Zealand for a short period of time (1

year or less) before re-exportation are known as temporary imports.

These types of shipments can be shipped free of any import duties or

taxes provided the goods will remain in the same condition as they

were imported.

The types of goods that classify as temporary imports include:

- Scientific and educational equipment, humanitarian or cultural

items, advertising to tourists

- Sports equipment (such as bicycles, skis and golf clubs)

- Professional equipment such as cameras, video recorders, sound

systems

- Materials for display at exhibitions, meetings, and trade fairs

Qualifying for Duty & Tax Free Temporary Import

In order to import your goods duty and tax free into New Zealand, you

can pick from 1 of the 3 Temporary Import Methods listed below.

Each option has its pros and cons. Regardless, each of the following

methods requires you to complete a Commercial Invoice (CI). More

details below

| Option # | Temporary Import Method | Risk of paying |

|---|

| 1 | Commercial Invoice Only (no other documentation is provided) | High - if broker cannot clear goods temporarily |

| 2 | Commercial Invoice + Apply for Temporary Import Entry (TIE) | Very Low |

| 3 | Commercial Invoice + ATA Carnet | Very Low |

| 1. Complete a Commercial invoice only

This is the simplest and quickest option. See example.

NOTE: You should be aware that

shipping using this method doesn't guarantee that your items

will be imported duty/tax free. Not all brokers will clear

goods as temporary imports (i.e. UPS, Fedex, DHL) nor is it

a guarantee that customs won't charge any duties and taxes.

2. CI + Apply for Temporary Import Entry In addition to completing a Commercial Invoice (CI) you can

also apply for a Temporary Import Entry (TIE). A TIE is an

electronic form that contains the details of your temporary

import. A TIE must be submitted electronically and done prior to

shipping. Once that is completed, you will get a TIE number.

That number must be indicated on your Commercial Invoice. A TIE can be completed by your customs broker (customs

clearance provided by the major carriers such as FedEx, UPS,

DHL, etc. do not offer this service) or for some products,

you can complete the form yourself via the TSW website. 3. CI + an ATA Carnet This option is great for items that frequently travel in and

out of the country. It's also great because once you have an

ATA Carnet, it is accepted by 176 countries worldwide making

the application process a one-time thing. In addition to declaring your commercial invoice as a

temporary import, you can get an ATA Carnet for the items

that are of temporary nature. ATA Carnets are beyond the scope of this article. You can

however, contact your local chamber of commerce and they

will be able to guide you along. You can also find more

information here: http://www.chamber.ca/carnet/ |

In addition to 1 of the 3 items above, the following conditions must also be met in order to qualify for a duty and GST free exemption:

- The goods arrive and leave in the same condition, i.e. they undergo

no repairs nor are they used in manufacturing

- They are not to be gifted, sold, exchanged, or distributed in New

Zealand

- Are not consumable, for example, clothing, medicines, paints,

lubricants

- Stay no longer than 12 months in New Zealand

NOTES: - If the above conditions are not followed, duties and taxes will be

charged as though the goods have been imported permanently.

- Your Customs broker can clear goods of a temporary nature (FedEx,

UPS, DHL, etc. typically cannot clear goods of temporary nature)

Temporary Imports Checklist

- Commercial Invoice clearly stating 'Temporary Import'. This must be written

in the General Description section and the Detailed Description of Goods. (see sample)

- The goods arrive and leave in the same condition, i.e. they undergo no

repairs nor are they used in manufacturing

- Stay no longer than the period listed above

- Include your ATA Carnet with your shipment (if applicable)

- Include the expected return date or the date that it was originally received

within the country (whichever applies)

- Any above listed items not listed in this checklist

Sources:

https://www.gov.uk/guidance/temporary-admission-customs-technical-handbook

https://www.mpi.govt.nz/travel-and-recreation/arriving-in-new-zealand/items-to-declare/can-i-bring-or-post-it-to-new-zealand/equipment-clothing-and-wooden-items/

Sample Commercial Invoice for Temporary Imports

| Ship To | Invoice |

|---|

Christchurch Tradeshow

James Smith

1 Abbott Street

Christchurch

New Zealand

Phone: 613-555-1234 | Carrier tracking number: 736534736

General Description:

Temporary Imports - Trade show booth and display equipment returning Jan 2027

Invoice number: 123456MGEP4916926

Customs Broker: UPS

Date: 28 May 2023 |

| QTY | Description of Goods | C/O | SubTotal |

|---|

| 1 box | Temporary Imports - Trade show booth and display equipment

| CA | $1032.00 |

Terms of Sale: None

Total number of packages: 1

Reason for export: Temporary Imports

Contact Name: James Smith

| Total Invoice Amount: $1032.00

Total Weight: 10.0 lbs

|

| Declaration Statement: I hereby certify that information provided

is true and complete to the best of my knowledge |

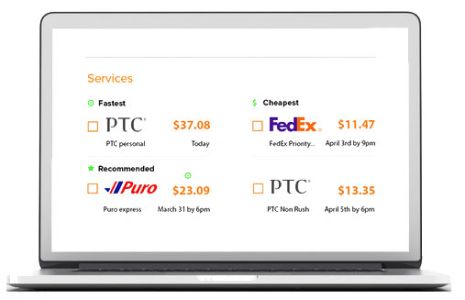

How much does it cost to ship internationally to New Zealand?

The prices to ship a package to New Zealand from Canada will vary

depending on a few things such as: Package Weight, Package Size, Number

of Packages, Destination City, Speed of Service, and any extra options

selected.

The best way to find out the cost to ship a box from Canada to New Zealand

is to use our

shipping estimate tool and get a real-time quote.

How long does parcel mail take from Canada to New Zealand?

Delivery times will vary widely by carrier and service level chosen.

Shipments can be delivered as soon as 2-7 business days if the shipment

is sent by air. CanadaPost has an International Surface Parcel that can

take 2-3 months for your package to be delivered.

It is important to note that the time in transit can be delayed by some of

these factors:

- Weather delays

- Emergency conditions

- Mechanical failures

- Customs holds

- Conditions beyond the Carrier's control

Secureship offers a tool to help determine the delivery times to New Zealand from Canada with all the major carriers.

Secureship makes it very easy to figure out the cost of shipping to New

Zealand. You can get an estimate on our website by using our online

estimate tool. The prices we display on the website are exact and are

based on the information provided at the time you did your quote. If the

weight, dimensions, or delivery information changes, the prices will

change.

Get a

shipping quote for cost of shipping to New Zealand from Canada here.

How long will it take for an envelope/box/parcel to get to New Zealand

from Canada?

Delivery times will vary by carriers and delivery options. You can have

your parcels delivered as early as 3 business days with 5-8 business

days as the standard delivery time-frame. There are slower and more

economical services such as the post office but they can take as long as

2-3 months to deliver your items.

Visit our real-time estimate tool to see

how long it will take your package to be delivered to New Zealand.

Does UPS deliver to New Zealand?

Absolutely, UPS delivers to New Zealand. You can use Secureship.ca to

send your shipments to New Zealand through UPS and save up to 50% off

the cost of going direct.

Get a

UPS shipping quote to New Zealand here.

How much does it cost to send a box to New Zealand?

The cost of sending a box to New Zealand from Canada will depending on

the size, weight, and dimensions of the box. Price can be as low as $5

depending on the carrier and weight/size of the box.

The best thing to do is get a

real-time quote using our Canada to New Zealand shipping estimate

tool. Simply enter the information based on the details of your box and

you'll get pricing for a wide variety of carriers.

What is the cheapest way to ship things internationally to New Zealand?

The cheapest way to ship to New Zealand is to use a discounted,

multi-carrier shipping platform like

Secureship. Not only will you save money (and time) by comparing prices using our

platform, you'll also get to take advantage of our group buying power

saving you easily up to 50% off the cost of shipping.

Find the

cheapest way to ship your package from Canada to New Zealand

here.

Can I ship luggage without a box to New Zealand?

You can ship luggage without a box to New Zealand but we highly

recommend against it. Luggage tends to get lost, has a high chance of

damage and is NOT insurable. It's best to repackage your items into a

cardboard box. It's easier for the driver and the carriers to handle

these types of packages, has less risk of loss, and doesn't incur extra

fees (carriers charge extra fees for items not encased in a cardboard

box).

Secureship has great general info on

how to package your goods to New Zealand here. If you are unsure about packaging your contents, you can always get

your items packaged at a UPS Store.