Feb 02, 2026 • by Paul Bourque

How much does it cost to send a package to Mexico?

A small priority shipment from Canada to Mexico could cost over $700 CAD, but using a broker and stretching out the delivery time cuts costs by a lot

by Paul Bourque

Nov 21, 2025

Key Points

Today, packages swirl around the globe with apparent ease, but anytime a box leaves Canada, the shipper needs to be aware that it is entering a sovereign nation whose rules and customs may differ from our own, and Germany is no different. This blog helps you navigate the regulatory intricacies of shipping from Canada to Germany and reminds the reader of the key pieces of paperwork demanded by international shipments. And like life itself, taxes are an unavoidable part of shipping, so we outline the duties and taxes German customs apply to incoming goods.

Table of Contents

Gifts are a common shipment from Canada to Germany, but there are some important regulations to be aware of before sending the parcel out.

For instance, the following goods have restricted limits:

When shipping foods to Germany, be advised that no more than 2 kg of the following items are allowed into the country:

Many more rules and regulations on goods entering Germany, which Secureship offers a summary of.

Any shipment bound for Germany, or any other foreign country, requires paperwork, and the nature of the goods determine which documents to be included. However, every parcel requires a commercial invoice and shipping label.

A person cannot enter a country without a passport, and so too a parcel, except it requires a commercial invoice (CI). A CI itemises the goods being shipped, and their values.

A shipping label seems too obvious a document to mention, but if it is incomplete or incorrect, that could lead to delayed deliveries or a lost parcel. Either way, it reflects poorly on the sender and could be an unnecessary expense.

So in addition to double-checking the recipient’s address, it could be helpful to add your telephone number in the event of an issue.

Typically, recipients pay the duties and taxes owed on imported goods, but there are occasions in which the shipper is responsible for them, and that depends on the International Commercial Terms (INCO) you are using.

Much of the goods traded between Canada and Germany are duty free or incur a very low rate. And for those that incur a duty, goods valued under 150 euros (about $250 CAD as of December 2025) will be duty free (except for alcoholic beverages and tobacco products).

Like most of the EU, Germany has a substantially higher VAT rate than Canada - 19%, and it applies regardless of the value of the goods entering the country. So, even a small item of several dollars will be charged VAT.

Even shipments to a valued trade partner like Germany must abide by the country’s importation laws and may be liable to duties and taxes. Thankfully for you, Secureship’s website provides anyone free access to the important basic shipping restriction of goods shipped from Canada to Germany. A short sampling includes: limits to amount of tobacco and alcohol that can be sent as gifts; restrictions to the types of foods and quantity German customs allow in. Also, it is worth reminding readers of the importance of providing a complete shipping label and commercial invoice on all parcels bound for Germany. Finally, be aware of the duties and taxes the goods may incur that the recipient will be liable for.

Feb 02, 2026 • by Paul Bourque

How much does it cost to send a package to Mexico?

A small priority shipment from Canada to Mexico could cost over $700 CAD, but using a broker and stretching out the delivery time cuts costs by a lot

Feb 02, 2026 • by Paul Bourque

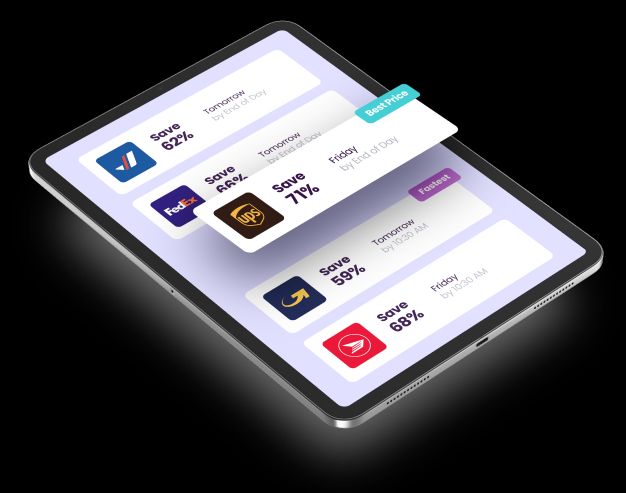

Which is the cheapest courier from Canada to Italy?

You find the cheapest courier to Italy with broker Secureship; they will save you a lot with FedEx, UPS, and Canada Post

Jan 09, 2026 • by Paul Bourque

Does Canada Post deliver to France?

Ship for less when broker Secureship arranges much cheaper shipping (at least 50%) with Canada Post on deliveries to France