Nov 21, 2025 • by Paul Bourque

How to ship a package from Canada to Germany

Certain goods shipped to Germany have restrictions and all parcels require a shipping label, commercial invoice, and may incur duties and taxes

by Paul Bourque

Jan 11, 2024

Key Points

FedEx is an internationally recognised courier and logistics company that delivers worldwide to 220-plus countries and territories, including India. With its fleet of 660-plus aircraft, FedEx can ensure that your documents and packages arrive at one of its 16 Indian clearance cities within days.

However, for the uninitiated, international shipping presents numerous small details to contend with, and can consume valuable time. So to help you, this blog guides you through the key steps to prepare your parcel for a trip to India, or indeed anywhere abroad with FedEx or any other courier.

Table of Contents

International shipping can be expensive for individuals and businesses, and the major contributing factor is the distance the parcel must travel. Needless to say, India is a long way from Canada, so you may be surprised what even a small package would cost to ship to Mumbai or New Delhi. And the pandemic and rising fuel costs have only boosted shipping costs.

So, the most cost-effective method of sending a parcel to India is by sea freight, but it could take months to arrive. With FedEx, their priority shipping service will get the parcel to India in three business days; economical service, in five business days.

Other significant factors affecting a shipment’s cost include: its size and weight; which courier you select and the arrival time; duties and taxes imposed by the country; and insurance (which is optional).

Your shipment is valuable and you want it to arrive intact. And as parcels are handled numerous times in transit, they could be dropped, bumped, or stuck under a stack of other boxes.

So, we advise the following practices when preparing your shipment for an international trip.

Note:

Secure packaging is particularly important if you have taken out insurance on the parcel’s safe delivery. To ensure the insurance remains valid, the packaging must conform to ISTA 3A packaging standards.

International non-document shipments require specific paperwork to allow for a smooth and unimpeded entry to the foreign country. Missing or incorrect information will likely cause a shipment’s arrival to be delayed, returned to Canada, or perhaps even incur fines. Generally, the documents required include: Commercial Invoice; Air Waybill; Customs Declaration Form; Certificate of Origin; Importer Exporter Code; Packing List; and perhaps other documentation depending on the nature of the contents.

Additional paperwork may also be necessary if the goods require a health certificate (e.g. foodstuffs); or a licence (e.g. medications); or other entry permits for controlled or restricted goods.

Indian customs apply duties and VAT (value added tax) to most parcels shipped from Canada to India. These fees are paid by the recipient and are calculated based on the CIF value of the shipment (the sum of its customs value, insurance amount, and freight costs).

Duties can range as high as 150% on spirits and wines, but most categories of goods will incur a 22% duty rate.

India’s VAT is set at four levels depending on the item.

Note : All eligible goods for duties and VAT will incur a charge regardless of its value even if it’s as trivial as a few dollars.

As we have discussed, international shipping can be expensive even for small packages, and it requires proper packing to ensure its safe passage as well as attention to varied pieces of paper. And finally, the recipient will be responsible for paying duties and taxes on the shipment’s contents.

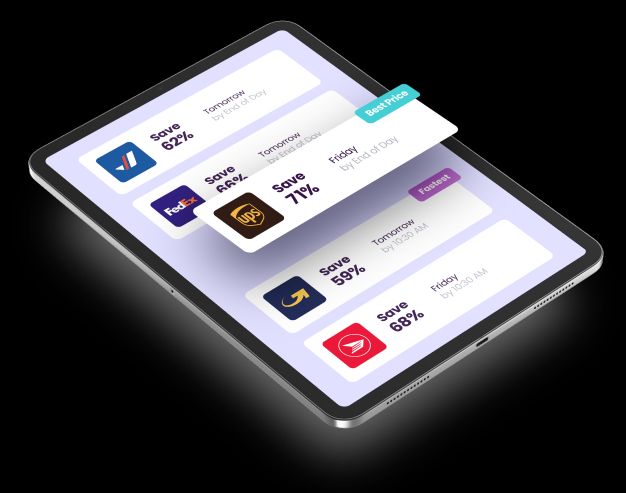

So, whether this is your first international shipment or you are a seasoned shipper, Secureship can help you save time and money getting your parcel or documents from Canada to India safely, with all the necessary paperwork, and with a full understanding of all the incurred duties and taxes.

Nov 21, 2025 • by Paul Bourque

How to ship a package from Canada to Germany

Certain goods shipped to Germany have restrictions and all parcels require a shipping label, commercial invoice, and may incur duties and taxes

Nov 17, 2025 • by Paul Bourque

How much does it cost to courier from Canada to France?

Many variables combine to determine the cost of shipping – delivery time, parcel size, and time of year, but Secureship always makes it cheaper for you

Nov 14, 2025 • by Paul Bourque

How much does it cost to send a package to Japan?

For a two-business-day delivery, rates to Japan can reach $500 for a light, modest parcel, but a lot less if the delivery time is extended