Can I ship to New Zealand with FedEx?

FedEx delivers to more than 220 countries and territories, and New Zealand is certainly one of this company’s destinations. And with FedEx’s fleet of 660-plus aircraft, this carrier ensures that your parcel will reach New Zealand within a few days of departing Canada.

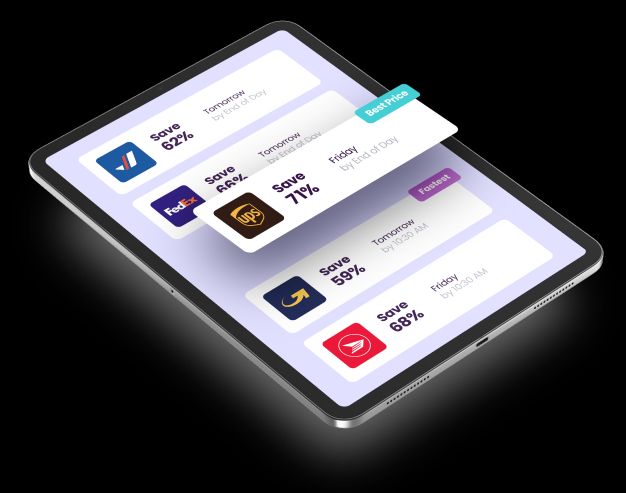

But before your parcel leaves your hands, there are a number of small details that require your attention and time. This blog outlines the key steps of preparing a package bound for New Zealand, or anywhere overseas whether it is with FedEx or another carrier of your choosing. And it introduces you to Secureship, a Canadian shipping broker that guides you through the paperwork and slashes your shipping costs.

Table of Contents

- International Shipping Basics

- Paperwork for International Shipments

- Preparing the Parcel

- Duties and Taxes

International Shipping Basics

The distance between shipper and recipient is the major factor that determines the cost of a parcel’s delivery. And it is well known that New Zealand sits more than 10,000 kilometres from any Canadian city, so shipping there is expensive even for small parcels.

One way to reduce shipping costs, therefore, is to send the parcel by surface transport, i.e. sea freight, the consequence is that it could take up to three months for its arrival. But using FedEx’s International Priority shipping service, your parcel could be delivered in five business days.

Of course, there are other notable factors that affect the total cost of a shipment. They include: the parcel’s weight and size; the country’s duties and taxes on incoming goods; which courier and service you choose; and if you decide to insure the shipment.

Paperwork for International Shipments

International shipments of non-documents, that is, a parcel containing goods, require a number of pieces of paper so that the goods enter a foreign country without any hitches. Failure to complete the forms correctly will surely delay the parcel’s entry to the country, and perhaps cause its return to Canada.

The two key documents required for shipments to New Zealand are the Commercial Invoice (CI) and Shipping Label (also known as the Bill of Lading).

Commercial Invoice (CI): The CI is the ticket that enables the parcel to enter the country. From the description and value of the goods on the CI, customs officials are able to apply the appropriate duties, fees, and value added tax (GST).

Shipping Label: This piece of paper provides the names, addresses of the sender and recipient as well as the courier accountable for the parcel’s delivery.

There are several other documents that may be required depending on the circumstances.

Certificate of Origin (COO): When shipping sold goods to New Zealand, the COO is proof that the goods were manufactured in Canada, and may allow them a reduced duty entry.

Packing List: This is required when shipping personal effects, for instance, if you were moving to New Zealand permanently or for a long term work contract.

And certain goods may require a health certificate (e.g. food and other agricultural products) or permission from a government authority (e.g. medicines).

Preparing the Parcel

At times, parcels endure rough handling during their long voyages. They are at risk of being dropped or crushed, so to ensure a parcel’s safe arrival in New Zealand we recommend employing the following steps:

- Only use a new shipping box; a used box could have lost 50% of its original certified strength

- Enfold individual items in package peanuts or bubble wrap

- Arrange the items at least 5 centimetres from each other and 5 centimetres from top and bottom and all walls

- Seal the box with proper packing tape only (no string, rope, masking or duct tape)

While no one wants to receive a damaged parcel, secure packaging is most important if the parcel has been insured. Insurance will only be valid if the packing conformed to ISTA 3A packaging standards.

Duties and Taxes

The preferential trade agreement between Canada and New Zealand results in many goods entering the country duty-free. Goods that do incur a duty are typically in the range of 5 – 10% with the exception of tobacco products and alcoholic beverages, which have a higher and variable rate dependent upon the product.

Like Canada, New Zealand has a GST (a value added tax), but its rate is 15%, and it applies to all incoming goods. There is, however, a de minimis value of $400 NZD, which means when shipping goods from Canada to New Zealand, if the parcel’s value is less than the de minimis, no GST will be charged.

Conclusion

FedEx’s worldwide network of aircraft and service vehicles can easily and quickly ship your parcels from Canada to New Zealand. But as discussed, proper preparation of the parcel and its accompanying paperwork are very important to ensure that the goods arrive undamaged and are allowed into the country.

To help you with these and other time-consuming details, Secureship brings its many years of experience to this chore. And more importantly, our bulk buying power can save you in a big way – up to 50% of your shipping costs.