Feb 02, 2026 • by Paul Bourque

How much does it cost to send a package to Mexico?

A small priority shipment from Canada to Mexico could cost over $700 CAD, but using a broker and stretching out the delivery time cuts costs by a lot

by Paul Bourque

Oct 06, 2025

Key Points

Table of Contents

Table of Contents

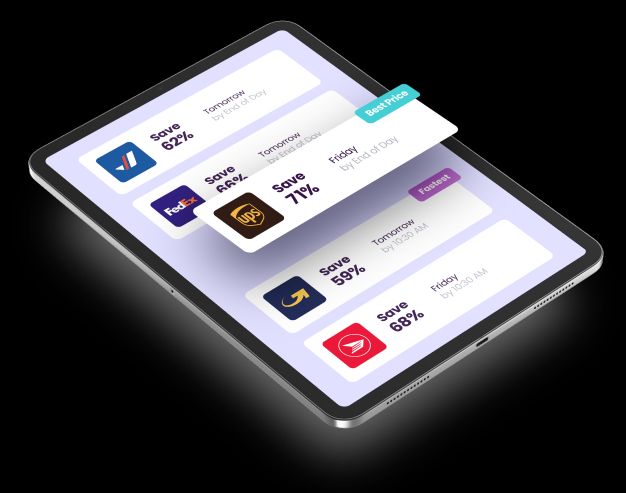

Canadian born and bred, Secureship has made purchasing agreements with noted private couriers - Purolator, UPS, FedEx - that results in substantially reduced shipping rates for its customers.

And to access those, you merely need to create an account, which is free and has no obligations - use it once or everyday, there are no monthly minimums, or a yearly fee.

In addition to your monetary savings with Secureship, you will also save time when arranging a shipment. That’s because our platform is modern and intuitive. Once you’ve selected a shipping option, the system guides you through the necessary paperwork and prompts you to arrange parcel pick-up at a time and place convenient for you, which could be your home or office.

While Canadians can ship many goods to Spain duty-free through CETA, countries require specific paperwork for their shipments. So, when shipping from Canada to Spain, all parcels must have a shipping label and commercial invoice.

The shipping label identifies the sender, recipient, and their relevant addresses. Be sure to write clearly and supply all information. Illegible or missing information will cause delivery delays, and that is never good for the bottom line.

The CV is a parcel’s passport. Without it, the parcel does not enter a foreign country.

It is also important that the CV correctly describes the enclosed goods so that customs can assess them accurately for duties and taxes owed.

Like most countries, Spain applies a value added tax to internal purchases and on incoming goods, which is equivalent to the Canadian GST.

The VAT rate is 21% on most shipments crossing Spain’s frontiers regardless of their value (unlike duties, which has a de minimis value of €150 - about $245 CAD as of October, 2025).

However, certain goods will only incur a 10% reduced rate and others a 4% highly reduced rate.

Many Canadians rely on Canada Post to deliver parcels to Spain and many other countries. And though that can be pricey, Canadian shipping broker Secureship significantly reduces your shipping costs with Purolator, FedEx, and UPS.

In addition to the monetary savings Secureship provides you, its easy-to-use platform smoothly guides you through the necessary paperwork, and further, you will find heaps of information on our website concerning Spain’s importation rules and taxes.

Feb 02, 2026 • by Paul Bourque

How much does it cost to send a package to Mexico?

A small priority shipment from Canada to Mexico could cost over $700 CAD, but using a broker and stretching out the delivery time cuts costs by a lot

Feb 02, 2026 • by Paul Bourque

Which is the cheapest courier from Canada to Italy?

You find the cheapest courier to Italy with broker Secureship; they will save you a lot with FedEx, UPS, and Canada Post

Jan 09, 2026 • by Paul Bourque

Does Canada Post deliver to France?

Ship for less when broker Secureship arranges much cheaper shipping (at least 50%) with Canada Post on deliveries to France