Feb 02, 2026 • by Paul Bourque

How much does it cost to send a package to Mexico?

A small priority shipment from Canada to Mexico could cost over $700 CAD, but using a broker and stretching out the delivery time cuts costs by a lot

by Sandy Ahluwalia

Feb 11, 2025

Key Points

Table of Contents

U.S. President Donald Trump, following through on a campaign promise, signed three executive orders on Feb 1, 2025, slapping tariffs on Canada, China, and Mexico. These included a hefty 25% tariff on imports from Canada and Mexico, with a reduced 10% rate on Canadian energy products and Chinese imports. And the justification for tariffs on Canada? Canada wasn’t doing enough to curb the flow of fentanyl and illegal immigration.

The move quickly flared into what many are calling a full-blown trade war. Canada hit back hard with retaliatory tariffs on U.S. goods, sending tensions between the two long-time trade partners skyrocketing.

Now, there’s a bit of a breather — Trump has agreed to a 30-day pause on tariffs for both Canada and Mexico. But as we all know, things can shift in the blink of an eye and the situation is far from over.

Case in point - Trump signed an executive order on Feb 10th, imposing tariffs on steel and aluminum.

So what does the trade war, mean for Canadians and how will it impact your shipping? Let’s dig in.

To understand the impact the trade war will have on Canadians, we must first understand what de minimis is.

“De minimis” is Latin for “of minimal importance.” In trade and customs, it refers to the dollar amount (aka. threshold) below which shipments are considered too little of value (aka. minimal importance) to warrant duties, taxes, or extensive processing.

Countries establish de minimis values to streamline international trade by exempting low-value shipments from duties, taxes, and extensive customs processing. Essentially, de minimis rules help expedite packages through the border that would otherwise cause border congestion for little-to-no benefit.

The de minimis value (or threshold) is the amount below which no taxes are applied.

Under the United States-Mexico-Canada Agreement (USMCA - formerly NAFTA), goods made in Canada, U.S., or Mexico have the following de minimis thresholds (i.e. tax-free):Importing into Canada:

Remember, these values only apply to goods made in the U.S. or in Mexico due to the USMCA agreement. Goods made in other countries are subject to duties & taxes if the value is over $20 CAD.

Importing into the United States (Section 321):

De Minimis Exceptions:

Some goods are always subject to duties and taxes, even below the de minimis threshold, including:

Historically, the de minimis in the U.S. was intended to give tax-free breaks for travellers bringing back small personal purchases from abroad. Today, under Section 321 of the U.S. Customs Rules, shipments valued under $800 USD can enter without incurring any duties, taxes, or brokerage fees.

With the evolution of online purchases, the de minimis has become the backbone of e-commerce operations and is crucial today for both global and local commerce. Companies worldwide have come to depend on it to keep cross-border costs low and enable efficient direct-to-consumer shipping.

In 2016, lawmakers increased the U.S. threshold from $200 USD to $800 USD under the Trade Facilitation and Trade Enforcement Act, significantly boosting cross-border commerce and further reinforcing its importance.

If the de minimis value in the U.S. were to be reduced or removed altogether (i.e. the amount that is considered tax-free is reduced or removed), this would mean that goods imported by Americans would be more expensive and lead to a decrease in demand. A Hicks Morley report stated that this decrease in demand has the potential to cause significant disruptions to the Canadian job market and economy.

If the U.S. implements the proposed 25% tariffs on Canadian goods, that would mean the suspension of the U.S. de minimis threshold. As we explored above, this has some pretty significant impacts on both Americans and Canadians. Of course, Canada has its own list of retaliatory tariffs it would impose on U.S. goods. But what does that ultimately mean?

There are a couple of important things worth noting.

Many Canadians have found what seemed like a great online deal, only to face unexpected hefty brokerage fees — sometimes doubling the cost of the goods, compared to buying them locally.

It all comes down to the de minimis value. FedEx and UPS charge brokerage fees on ground shipments that are valued above the de minimis value / threshold.

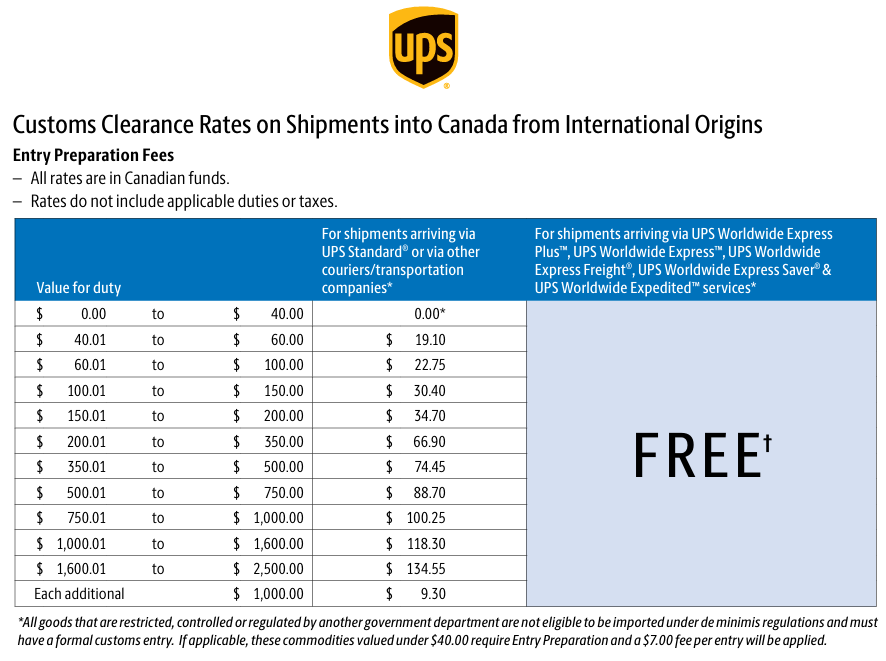

According to the 2025 UPS Canada Rate chart, your brokerage fee (aka Customs Clearance Rate) starts at $19.10 CAD and can climb to over $134.55 CAD, depending on the customs value of the shipment.

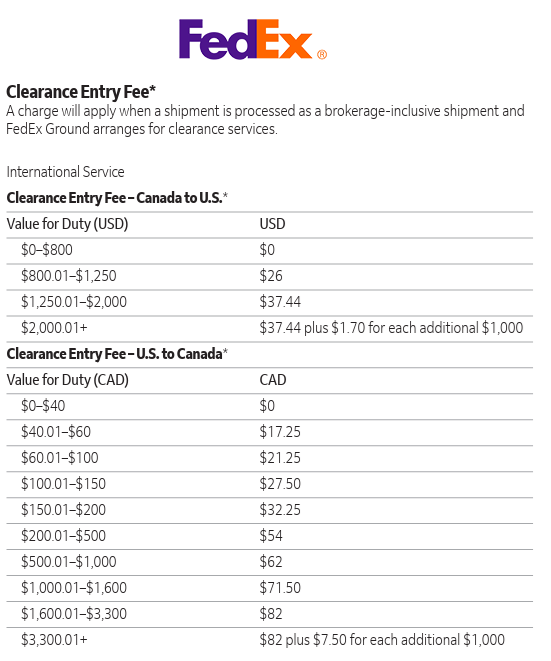

The 2025 FedEx Canada Ground Rate Guide shows a brokerage fee starting at $17.25 CAD and progressing upwards

These charges are frustrating but familiar for a lot of Canadians. With the blanket tariffs on Canadian, Mexican, & Chinese goods, many Americans will now experience these dreaded brokerage fees.

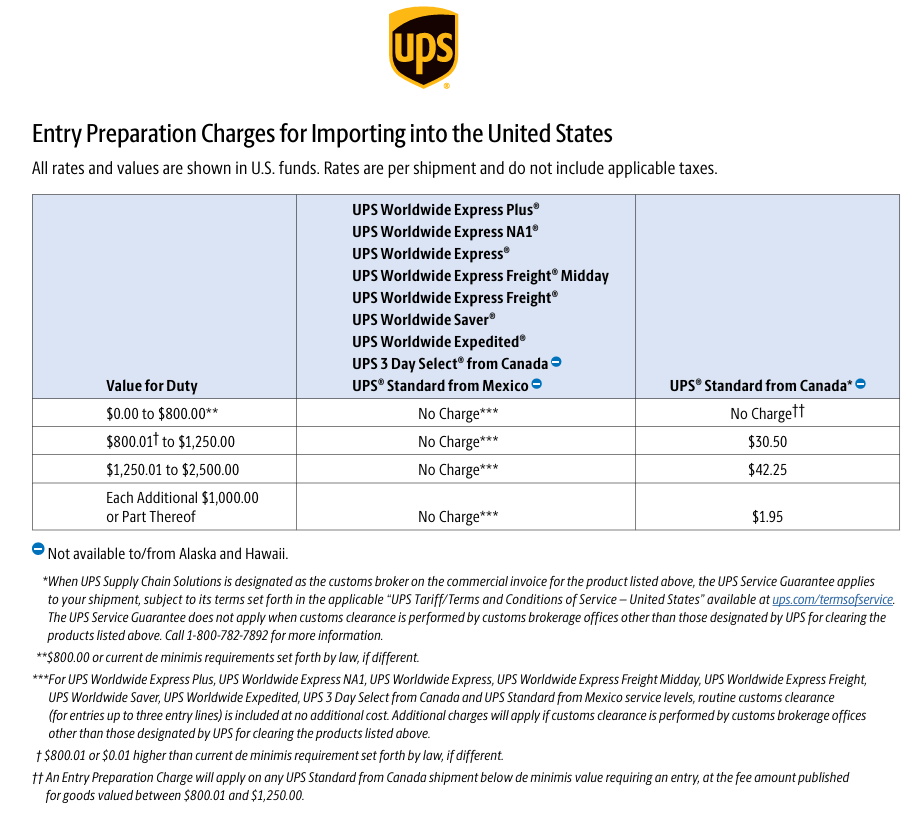

Based on the 2025 UPS U.S. Rate Guide, Americans receiving shipments via ground service will incur a $30.50 USD brokerage fee + disbursement fee.

Unfortunately, there’s little you can do here. Customs officials & brokers are very good at determining if an item is under-valued or under-declared. And that can lead to a reassessment of value, and in some countries, it can result in penalties, fines, or additional duties being imposed on the shipment

Duties and taxes are based on where the goods were manufactured. According to Audrey Ross, import and export compliance manager for Orchard Custom Beauty, “Products with parts still made in China could be assembled elsewhere before entering the U.S. and avoid possible de minimis scrutiny”.

This does not provide much benefit for Canadian products shipped to the U.S. but it could provide some advantages for goods from other countries that are subject to higher tariffs, as manufacturers may shift assembly locations strategically to reduce duties.

There are several ways that these brokerage fees can be mitigated, though some are beyond the scope of this article

For low weight, high value shipments, ship your package via Air or Express. Carriers offer routine customs clearance as part of their Air/Express service.

You can advise the carrier to use a different customs broker.

You can notify the carrier that you will self-clear the packages.

The trade war has elicited strong reactions from Canadians and various provinces, sparking feelings of betrayal and a surge in economic patriotism.

In response, Canadians are increasingly rallying around ‘Buy Canadian’ campaigns to boost the local economy and reduce reliance on U.S. goods. This movement has led to a notable rise in sales of Canadian-branded items and a collective effort to support local businesses.

Ontario cancelled a $100 million CAD contract with Elon Musk’s Starlink, a satellite internet service, as a retaliatory measure against U.S. tariffs. Premier Doug Ford stated that Ontario “won’t do business with people hellbent on destroying our economy”.

B.C. has taken steps to ban the sale of American alcohol, particularly targeting products from Republican-led states. This move is to encourage consumers to choose local alternatives and support the provincial economy

Quebec Premier François Legault has directed the government to review and penalize procurement contracts involving American suppliers. Additionally, the Société des Alcools du Québec (SAQ) has been instructed to remove American products from its shelves, further promoting local consumption.

The U.S. trade war has encouraged Canadians to support local businesses and explore global markets for diversification. Secureship, a proudly Canadian company, is helping by making trade more efficient and cost-effective through its extensive shipping partner network and competitive pricing.

Secureship has partnered with Canada Post to provide you with even better shipping rates within and between provinces.

| From | To | Weight | Retail | Via Secureship |

|---|---|---|---|---|

| Toronto | Montreal | 10 lbs | $24.41 | $16.83 |

| Calgary | Edmonton | 1 lbs | $20.25 | $15.13 |

| Vancouver | Halifax | 25 lbs | $56.41 | $46.54 |

| Ottawa | Montreal | 1 lbs | $17.07 | $11.34 |

| Saskatchewan | Winnipeg | 40 lbs | $59.28 | $43.43 |

| Quebec City | Toronto | 14 lbs | $29.28 | $20.08 |

Secureship has managed to secure savings upwards of 70% on packages shipped through UPS & FedEx while streamlining the entire shipping process. This provides you with an excellent opportunity to expand your business to 220 countries and territories worldwide.

| From | To | Weight | Retail | Via Secureship |

|---|---|---|---|---|

| Canada | Australia | 10 lbs | $649.81 | $207.14 |

| Canada | India | Envelope | $242.67 | $92.75 |

| Canada | United Kingdom | 25 lbs | $825.78 | $292.84 |

| Canada | France | 5 lbs | $350.03 | $121.31 |

| Canada | Mexico | Envelope | $345.02 | $79.24 |

| Canada | China | 40 lbs | $1,440.02 | $471.94 |

And whenever you’re ready to Ship to the United States, we can help you with that. Savings are upwards of 60%.

| From | To | Weight | Retail | Via Secureship |

|---|---|---|---|---|

| Toronto | New York City | 15 lbs | $63.86 | $32.45 |

| Montreal | Miami | 25 lbs | $105.51 | 53.26 |

| Vancouver | Los Angeles | 50 lbs | $162.84 | $77.66 |

The ongoing trade war has Canadians concerned about what lies ahead. With increasing volatility from the U.S., there’s never been a better time to buy local and look to expand globally.

Secureship — a proudly Canadian business — can help by reducing barriers, complexity, and cost.

Let us help you find stability in uncertain times. Happy Shipping!

Feb 02, 2026 • by Paul Bourque

How much does it cost to send a package to Mexico?

A small priority shipment from Canada to Mexico could cost over $700 CAD, but using a broker and stretching out the delivery time cuts costs by a lot

Feb 02, 2026 • by Paul Bourque

Which is the cheapest courier from Canada to Italy?

You find the cheapest courier to Italy with broker Secureship; they will save you a lot with FedEx, UPS, and Canada Post

Jan 09, 2026 • by Paul Bourque

Does Canada Post deliver to France?

Ship for less when broker Secureship arranges much cheaper shipping (at least 50%) with Canada Post on deliveries to France